Dernière mise à jour : 15 janvier 2021

Détails

État du projet:

Terminé

Gamme de produits:

Examen d’une technologie de la santé

Sous-type de projet :

Utilisation optimale

Numéro de projet :

OP0546-000

Final Biosimilar Summary Dossier Issued:

Abbreviations

| AI | artificial intelligence |

| CADTH | Canadian Agency for Drugs and Technologies in Health |

| CAR | Canadian Association of Radiologists |

| CCOHTA | Canadian Coordinating Office for Health Technology Assessment |

| CDST | clinical decision support tool |

| CIHI | Canadian Institute for Health Information |

| CMII | Canadian Medical Imaging Inventory |

| COCIR | European Coordination Committee of the Radiological, Electromedical and Healthcare IT Industry |

| CT | computed tomography |

| FTE | full-time equivalent |

| MRI | magnetic resonance imaging |

| MRT | medical radiation technologist |

| OECD | Organisation for Economic Co-operation and Development |

| PACS | picture archiving and communication system |

| PET | positron emission tomography |

| PET-CT | positron emission tomography–computed tomography |

| PET-MRI | positron emission tomography–magnetic resonance imaging |

| SPECT | single-photon emission computed tomography |

| SPECT-CT | single-photon emission computed tomography–computed tomography |

Key Messages

The Canadian Medical Imaging Inventory (CMII) documents current practices and developments in the supply, distribution, technical operations, and general clinical and research use of advanced imaging equipment across Canada. The report tracks where imaging capacity exists, exam volume, hours of operation, and types of use. Data are presented on human resources, funding structures, ordering and referral practices, and the adoption of tools that may support appropriate imaging, system efficiencies, and wait-list reductions. Comparisons with other countries are reported, as well as trends and projections on imaging capacity. This information may be used to inform capital planning and equipment replacement strategies, identify gaps in service, and anticipate future demand.

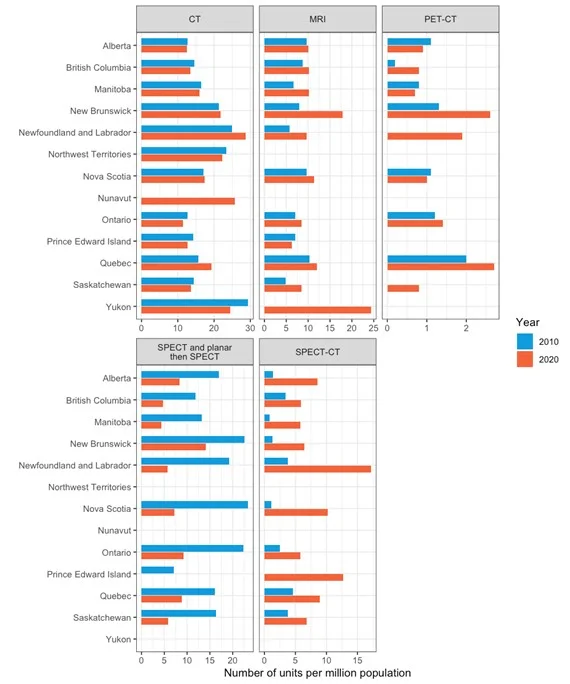

- CT is the most widely distributed advanced imaging modality across Canada (549 units), followed by MRI (378 units), single-photon emission computed tomography ( SPECT) (305 units), SPECT-CT (271 units), PET-CT (57 units), and PET-MRI (5 units).

- Regarding the total volume of exams, CT is the most-used modality (5.41 million exams per year), followed by MRI (2.33 million exams per year), SPECT and SPECT-CT combined (1.2 million exams per year), and PET-CT (125,775 exams per year). PET-MRI is used only for research purposes.

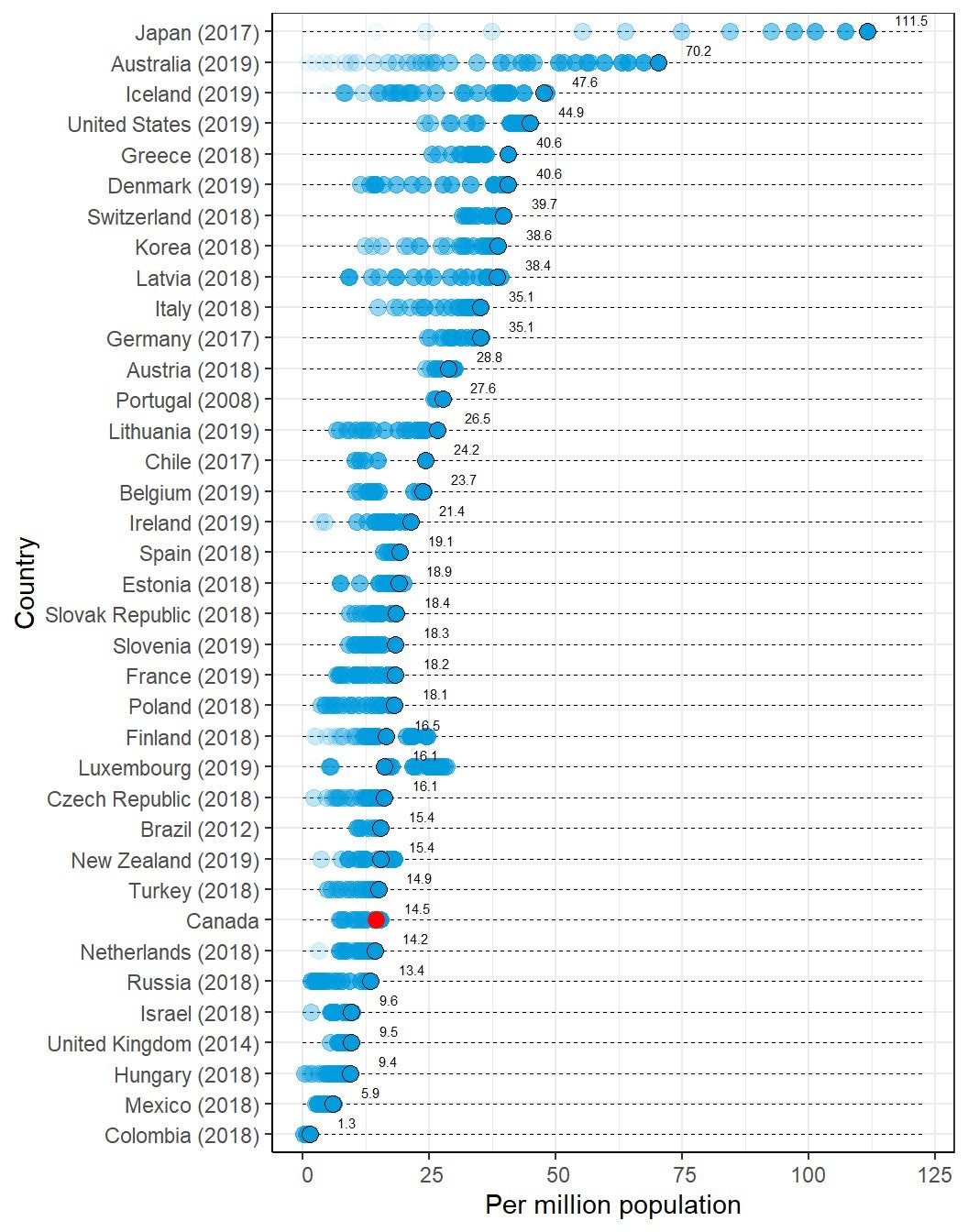

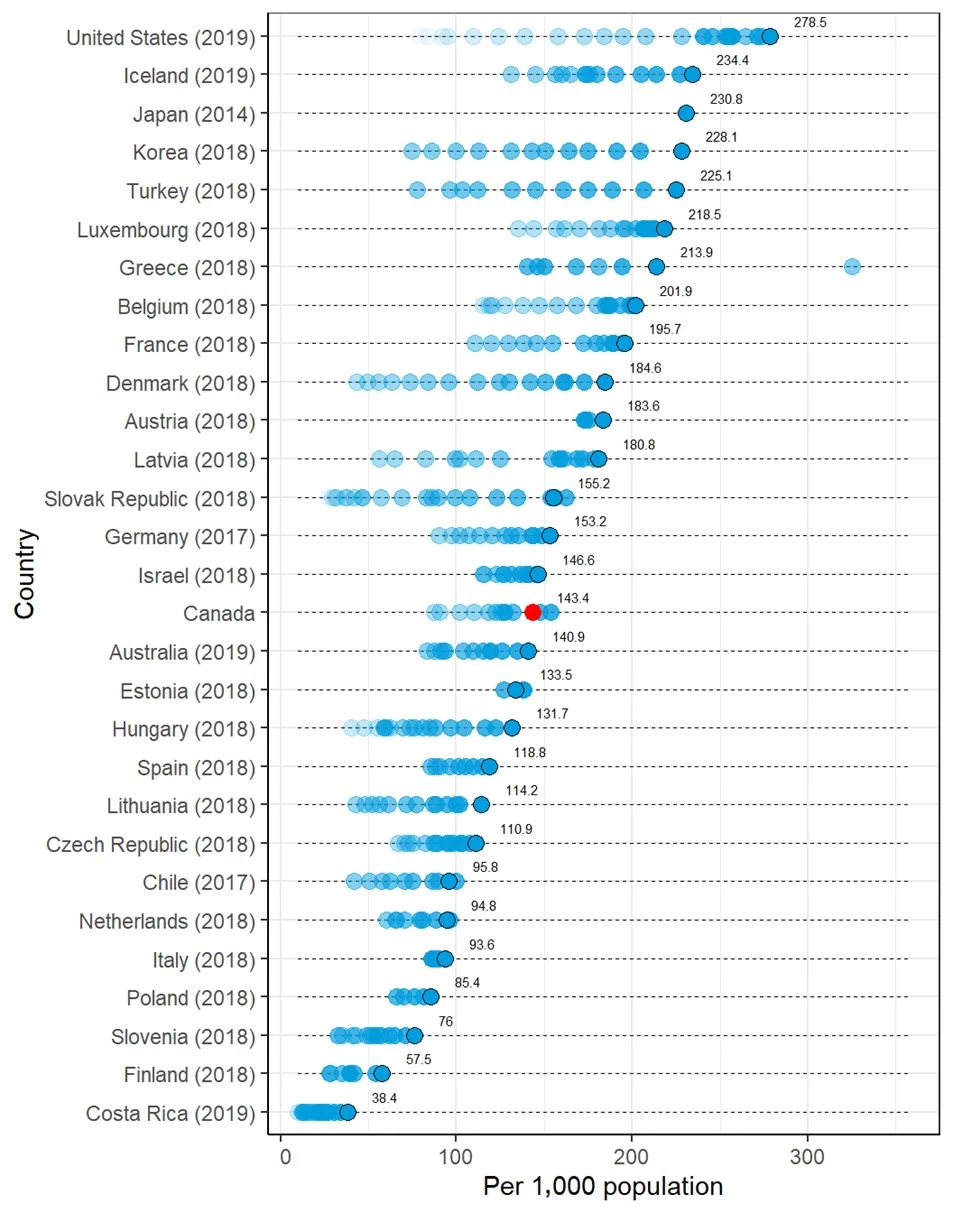

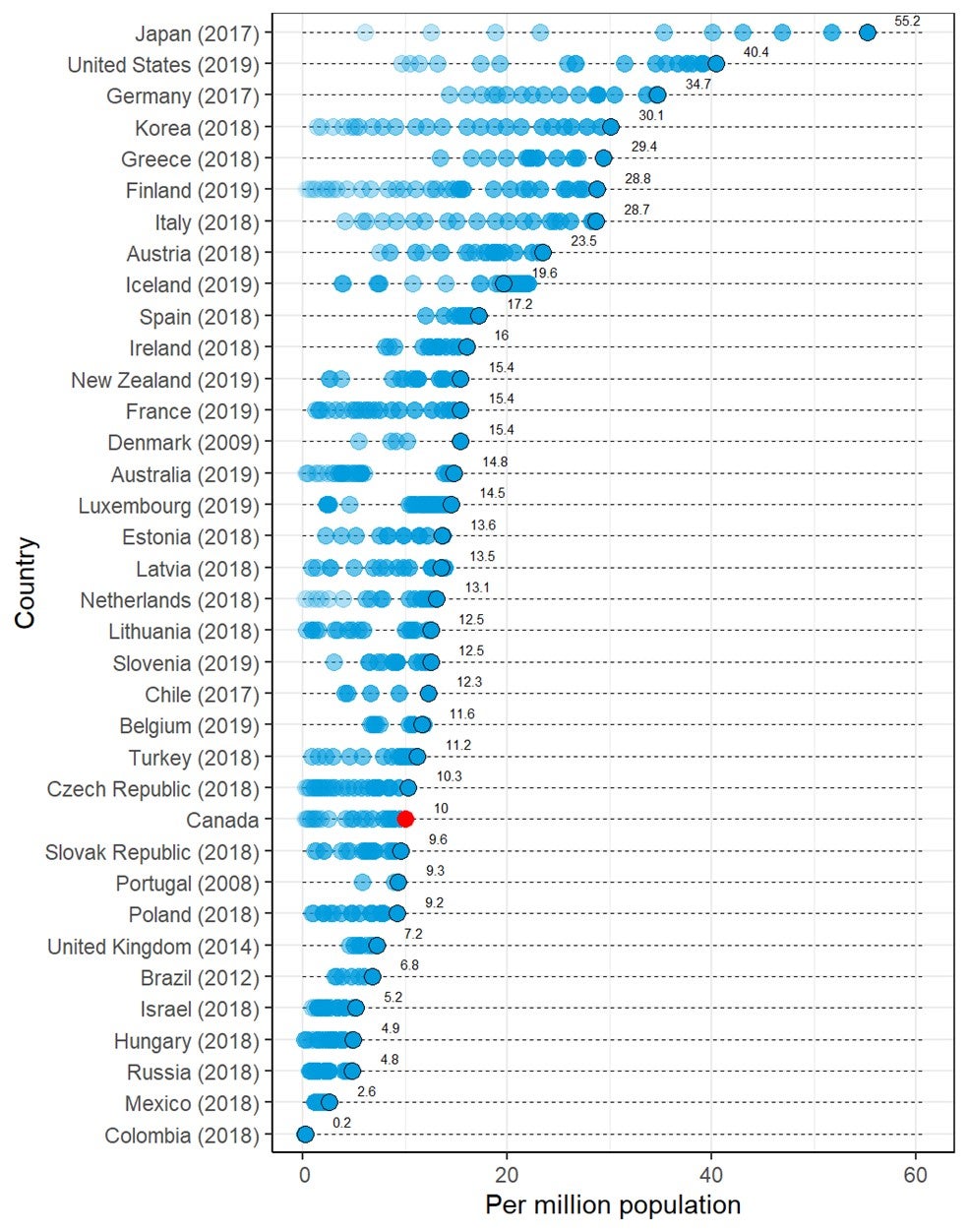

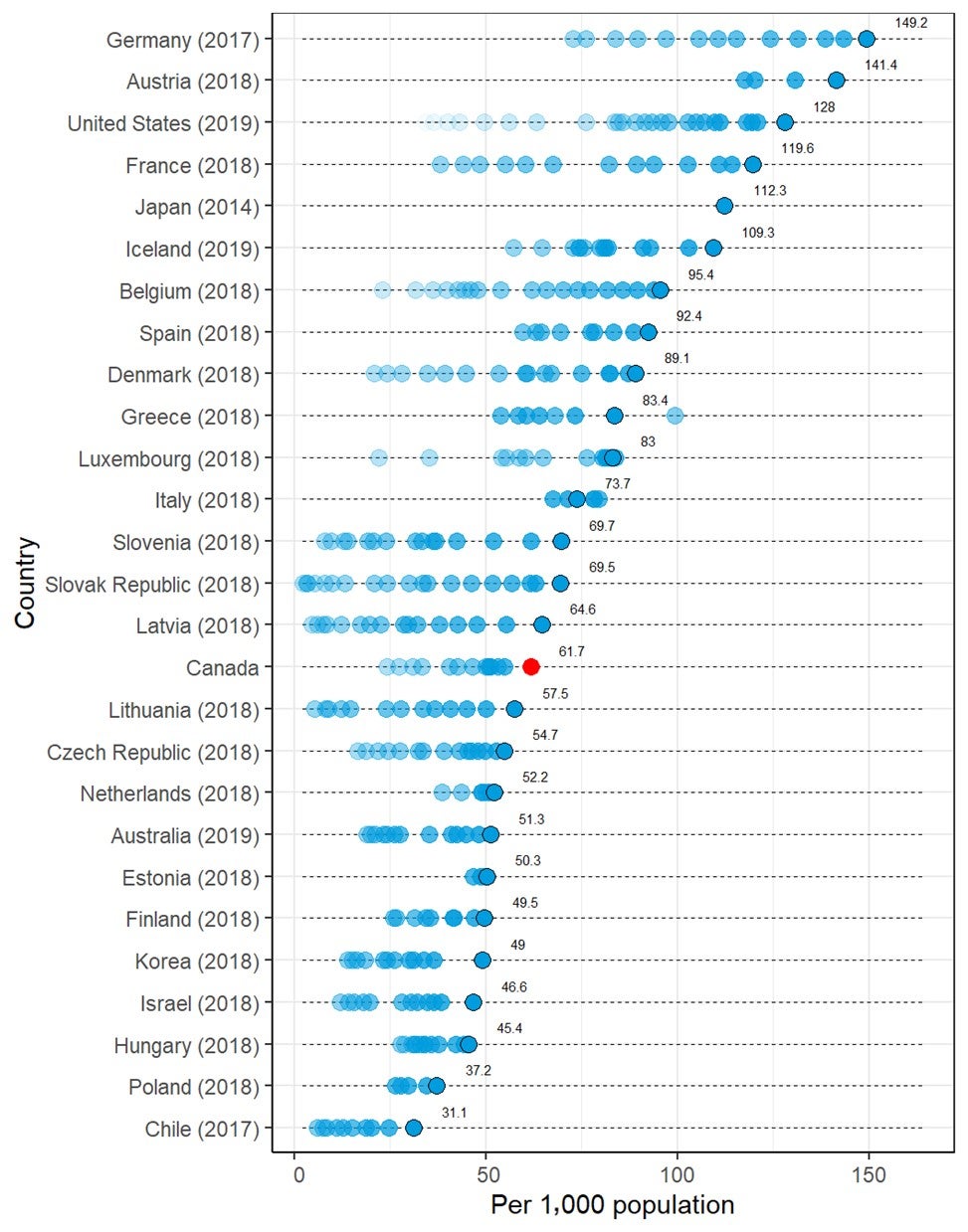

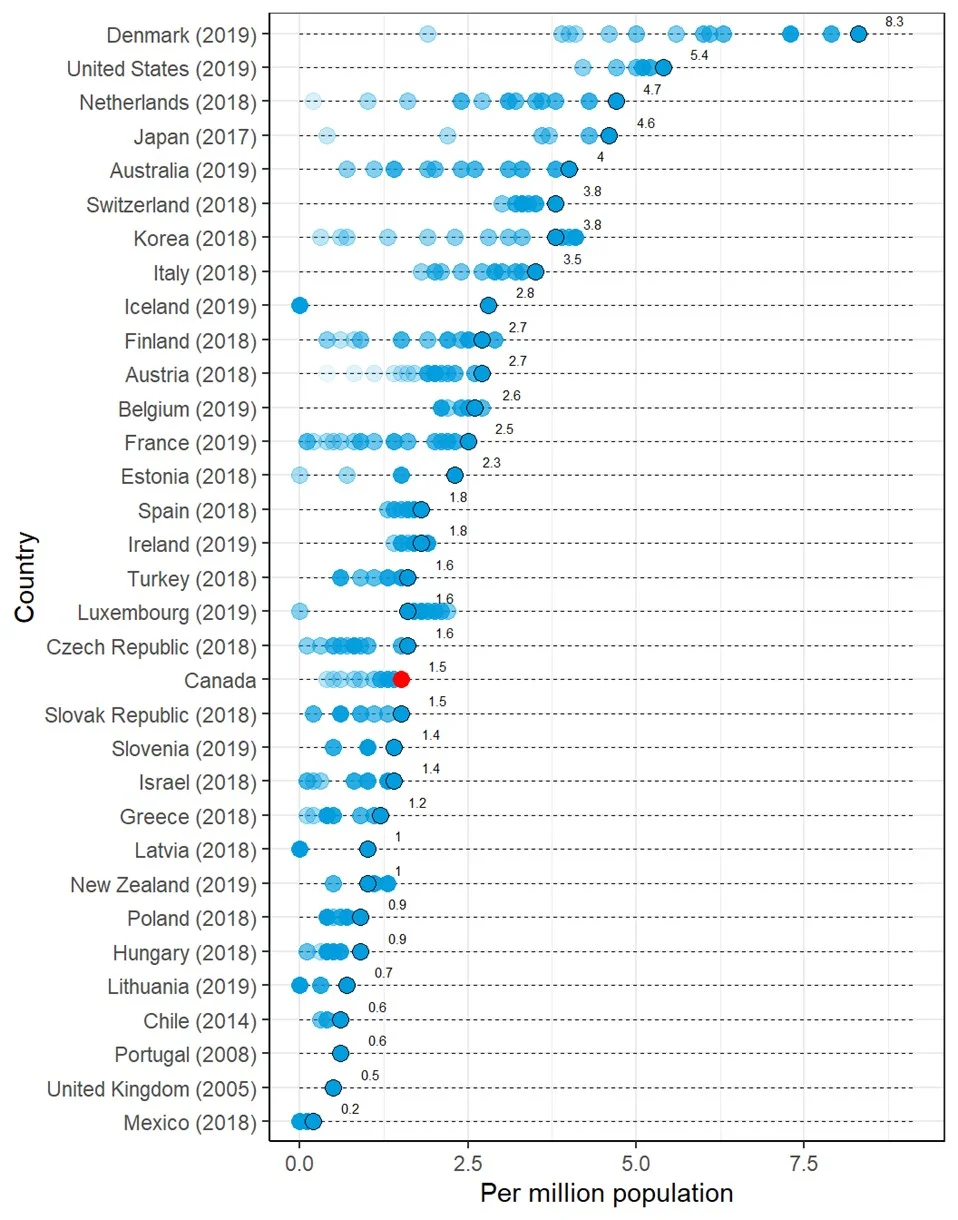

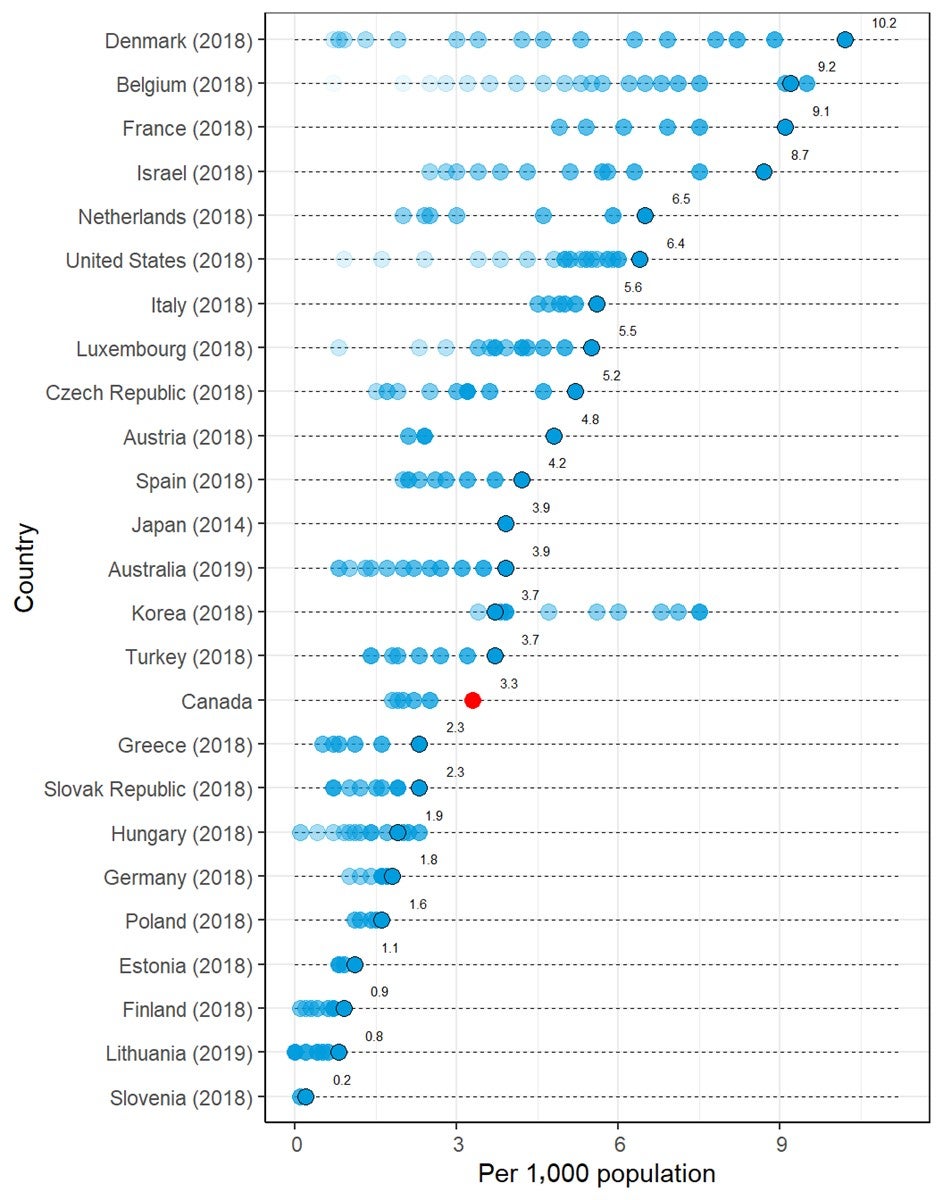

- Compared to other countries, Canada appears in the lower tertile for the number of units per million people for CT, MRI, and PET-CT, and below the median for the volume of CT, MRI, and PET-CT exams per thousand population.

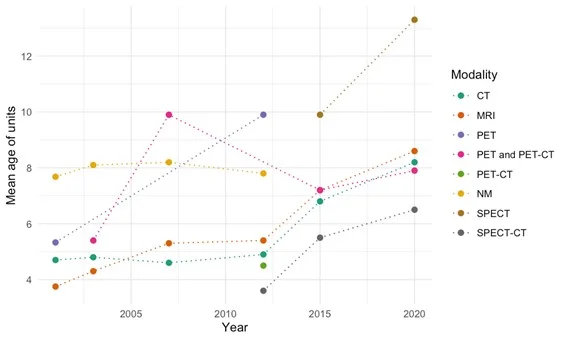

- Approximately 60% of imaging equipment has been operating for 10 or fewer years (with some variance between modalities).

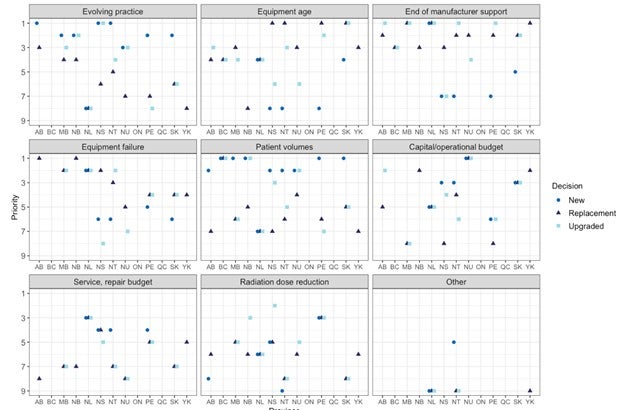

- The main drivers for decisions to replace existing equipment are equipment age, end of manufacturer support, and equipment failure.

- The most commonly used exam requisition method for all imaging modalities across Canada is paper and fax.

- While the adoption of picture archiving and communication systems (PACS) is extensive across Canada, not all sites are able to share images if they are on separate networks with different protocols.

- A process for determining the appropriateness of imaging exams is in place in 84% of imaging facilities. The most commonly used process to ensure the appropriateness of exams is radiologist review of referral.

- Artificial intelligence (AI) is used in at least 40 imaging departments for clinical and research purposes. While the use of AI varies across jurisdictions, it is used in all provinces. And AI is used for all imaging modalities, with most of its use in CT for image reconstruction, lowering radiation dose, and for reading and interpreting images.

Abstract

Background

Context and Policy Issues

The purpose of the CMII is to document current practices and developments in the supply, distribution, technical operations, and general clinical use of advanced imaging equipment across Canada. Medical imaging is a vital component of modern health care, playing a role in the diagnosis, staging, and monitoring of many diseases and conditions. As new medical imaging technologies become available and population needs change, it is important to keep track of where imaging capacity exists, how equipment is used, and the adoption of tools that may support appropriate imaging, system efficiencies, and wait-list reductions.

Methods

CADTH collected data on six advanced imaging modalities: CT, MRI, PET-CT, single-photon emission computed tomography (SPECT), SPECT-CT, and PET-MRI using a web-based survey and a search of the literature. The data were reviewed by validators for accuracy and validators provided additional information of provincial and regional policies and practices.

Summary of Evidence

Of the modalities surveyed, CT is the most widely distributed, with the highest number of units, followed by MRI. All provinces and territories have at least one CT unit; all provinces and Yukon have at least one MRI unit; and all provinces have at least one SPECT and/or SPECT-CT unit. None of the territories have SPECT or SPECT-CT. Nine provinces have PET-CT in clinical use. Two provinces, Alberta and Ontario, have PET-MRI that is used for research purposes.

Regarding the total volume of exams, CT is the most-used modality (5.41 million exams per year), followed by MRI (2.33 million exams per year), SPECT and SPECT-CT combined (1.2 million exams per year), and PET-CT (125,775 exams per year).

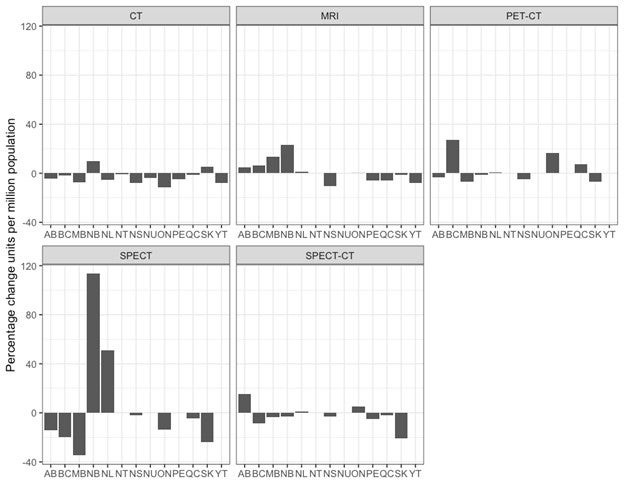

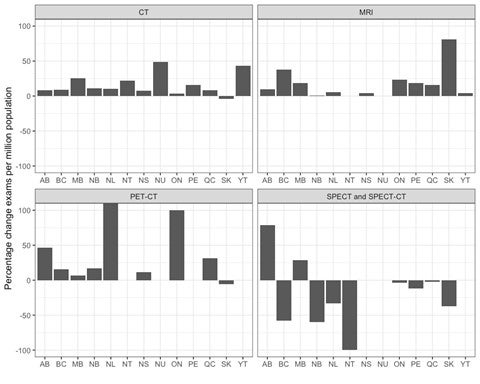

Each imaging modality, apart from SPECT, experienced growth in the last decade in Canada in the number of units and the number of units per million people. CT experienced the slowest growth rate of all imaging modalities — at a 1.4% increase in units per million people over the last decade — compared with other imaging modalities (MRI 20%; PET-CT 25%; and SPECT-CT 70%).

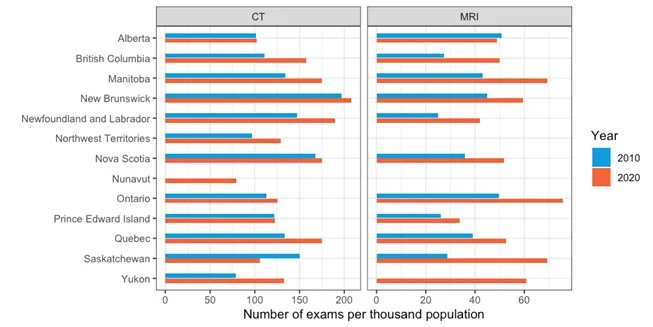

Over the last decade, the overall volume of exams increased by 32% and 62% for CT and MRI, respectively. Similarly, the number of exams per thousand population increased by 18% and 46%, respectively. Examination data for the other modalities were not available in 2010.

Conclusions and Implications for Decision or Policy-Making

The CMII data provides insight into the current context of medical imaging across Canada and raise questions related to how medical imaging is monitored and regulated, and how it is optimally used. As well, the data raise questions about how funding structures are organized, what the most cost-effective practices are, and whether access is equitable, especially in rural and remote areas. Overall, the findings of this report may help decision-makers identify gaps in service; inform medical imaging-related strategic planning on a national, provincial, or territorial basis; and help anticipate future growth and need for replacement. Additionally, the data can be used to identify system efficiencies and monitor the adoption of practices and tools that may support appropriate imaging and wait-list reductions.

Executive Summary

The purpose of this inventory is to document current practices and developments in the supply, distribution, technical operations, and general clinical use of advanced imaging equipment. This is the third iteration of the Canadian Medical Imaging Inventory (CMII) since CADTH resumed the collection of this data in 2015. Previously, the Canadian Institute for Health Information (CIHI) collected data on medical imaging technologies in Canada from 2003 to 2012.

Methods

Information was collected on six imaging modalities using a web-based survey, supplemented with information from provincial and territorial validators, report peer reviewers, and literature searches. The imaging modalities were:

- CT

- MRI

- single-photon emission computed tomography (SPECT)

- PET-CT

- PET-MRI

- SPECT-CT.

The survey opened on November 27, 2019, and data collection formally closed on February 11, 2020. Data from the previous iteration of the survey were saved, and respondents were invited to update the data associated with their sites or, if there was no pre-existing entry, to complete the survey. High-level data were reviewed by pre-identified regional and provincial validators, who supplied corrections and supplementary data, which were entered in the database. Identified stakeholders and survey respondents were given the opportunity to review the report during the stakeholder feedback process.

Results

Data from 455 sites were used to inform the findings of this report. Updated or new survey responses were received for at least 244 sites. Provincial and territorial validators provided some information for nonresponding publicly funded health facilities. The majority of sites were publicly funded. Seventy-three percent of sites were urban, 24% were rural, and 2% were remote.

Computed Tomography

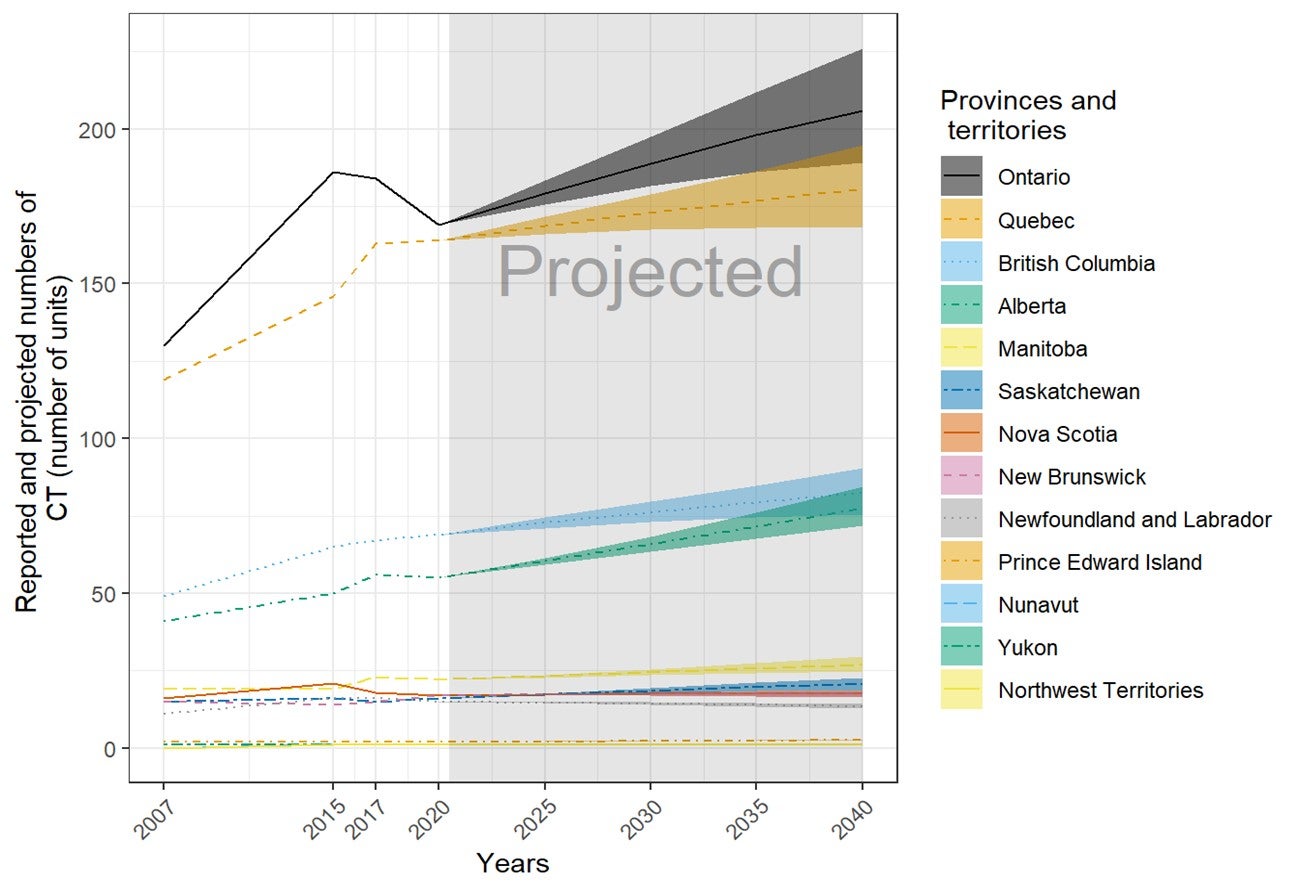

- A total of 549 CT units were identified in Canada, up from 484 in 2010. All provinces or territories had at least one unit. Ontario and Quebec had the most units, followed by British Columbia and Alberta. The three northern territories had one unit each.

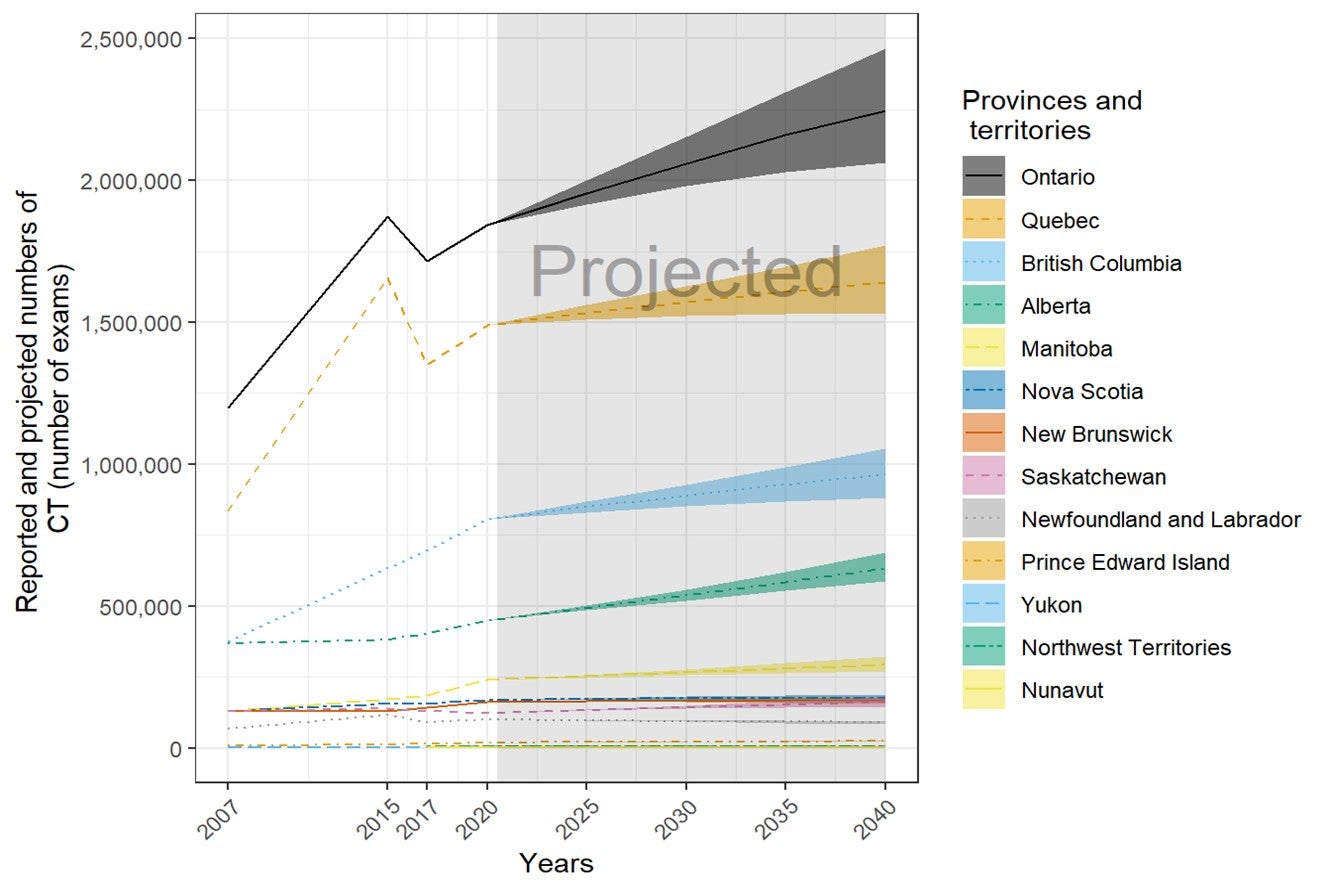

- An estimated 5,419,821 CT examinations were performed in the most recent fiscal year in Canada, up from 4,122,158 in 2010. This is equivalent to 143.4 exams per thousand people, up from 121.9 in 2010.

- In the next 20 years, the volume of CT exams is anticipated to increase by 18%, based on population projections and current use.

- CT units operate for an average of 80.5 hours per week and 12.6 hours per day. Most operate on weekends. CT is used across disciplines, with approximately one-quarter of the time used in the field of oncology, followed by neurology, hepatobiliary exams, and respiratory exams.

- When the number of CT units per population for Canada is compared with that in other countries that report CT units to the Organisation for Economic Co-operation and Development (OECD), Canada appears in the lower quarter of the reported numbers. For the number of exams per population, Canada appears around the midpoint.

- Referring physicians use clinical decision support tools (CDSTs) for 61% of CT exams ordered at the point of care.

- One-third of CT units are five years old or less, 28% are six to 10 years old, 27% are 11 to 15 years old, and 5% are 16 to 20 years old.

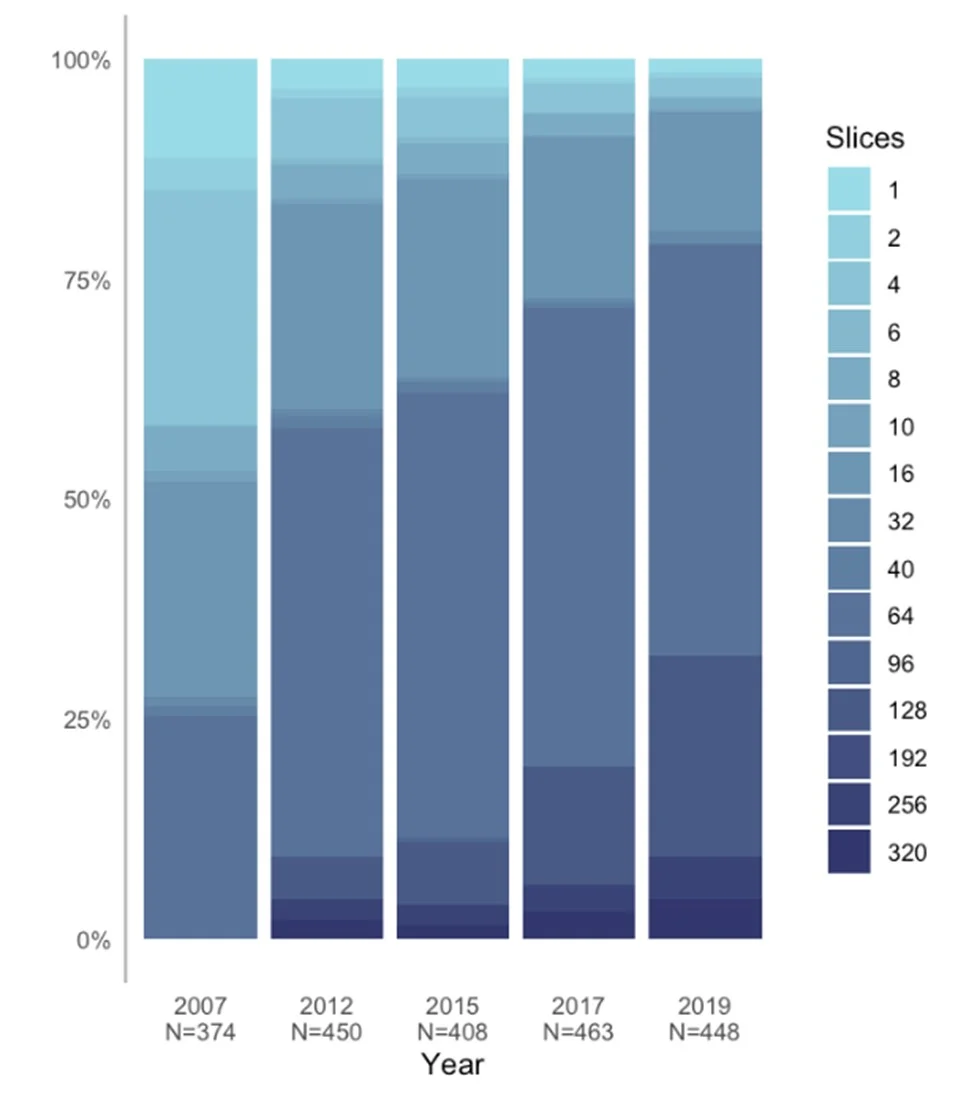

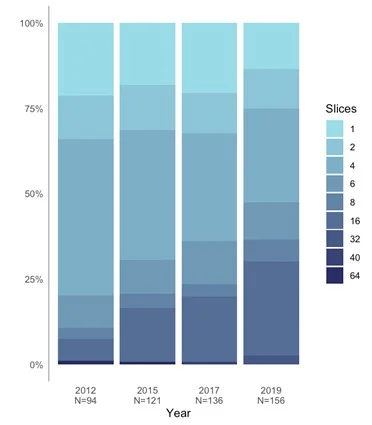

- Almost half of CT units have 64 cross-sectional images or slices, and about one-quarter have 128 slices. More than three-quarters of CT units incorporate image reconstruction techniques for dose reduction, 88% are equipped with dose-management controls, and 95% record dose by exam.

Magnetic Resonance Imaging

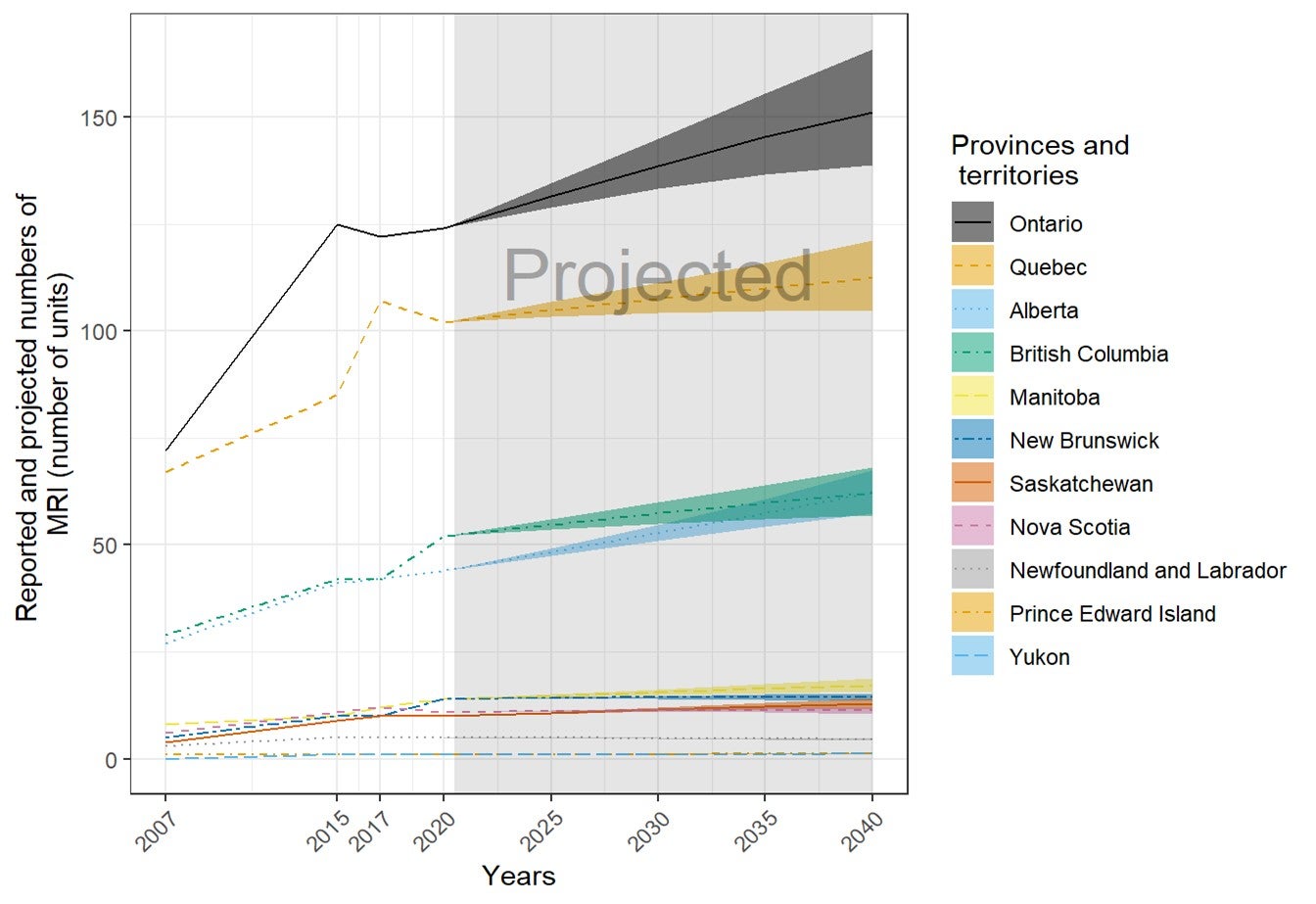

- A total of 378 MRI units were identified in Canada, up from 281 in 2010. All provinces and one territory have at least one unit. Ontario and Quebec have the most units, followed by British Columbia and Alberta. Yukon and Prince Edward Island have single units.

- An estimated 2,330,223 MRI examinations were performed in the most recent fiscal year in Canada, up from 1,434,499 in 2010. This is equivalent to 61.6 exams per thousand people, up from 42.4 per thousand people in 2010.

- In the next 20 years, the volume of MRI exams is anticipated to increase by 20%, based on population projections and current use.

- MRI units operate for an average of 87.8 hours per week and 14.1 hours per day. More than half operate on weekends. MRI is used across disciplines, with half of all use split between neurology and musculoskeletal exams, followed by oncology and hepatobiliary exams.

- When the number of MRI units per population for Canada is compared with that in other countries that report MRI units to the OECD, Canada appears in the lower third of the reported numbers. For the number of exams per population, Canada appears around the midpoint.

- Referring physicians use CDSTs for 18% of MRI exams ordered at the point of care.

- Less than one-third of MRI units are five years old or less, 26% are six to 10 years old, 26% are 11 to 15 years old, and 10% are 16 to 20 years old.

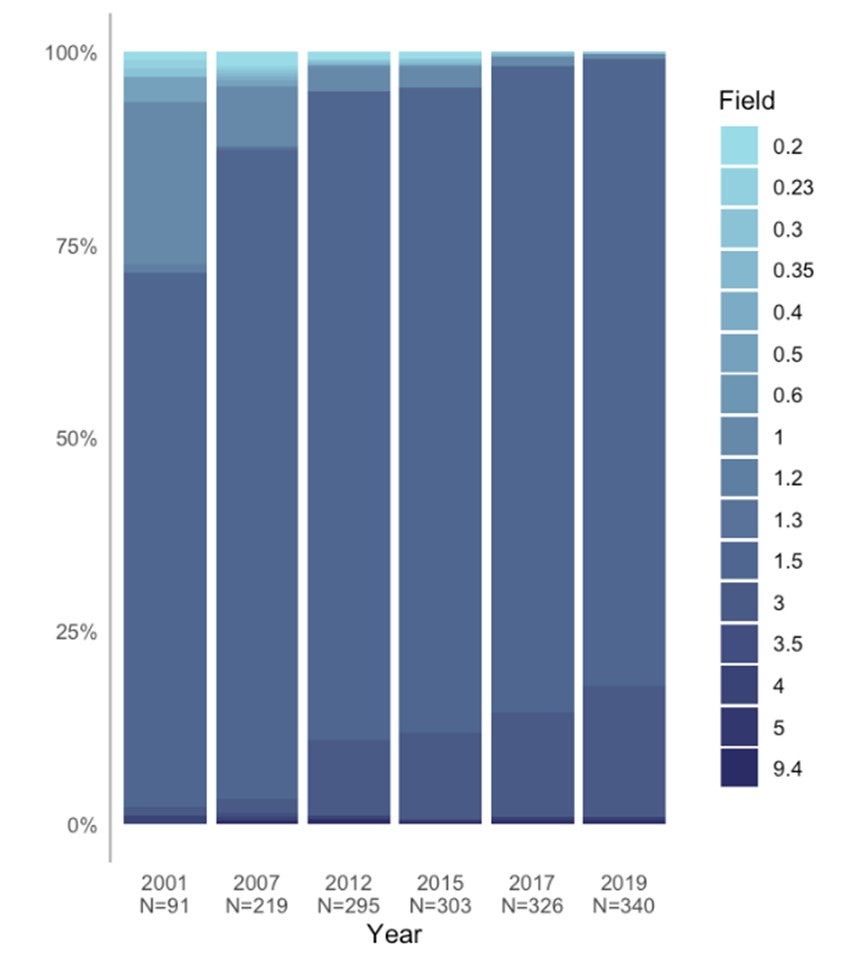

- The majority (80%) of MRIs have field strengths of 1.5 tesla.

Positron Emission Tomography–Computed Tomography or Positron Emission Tomography

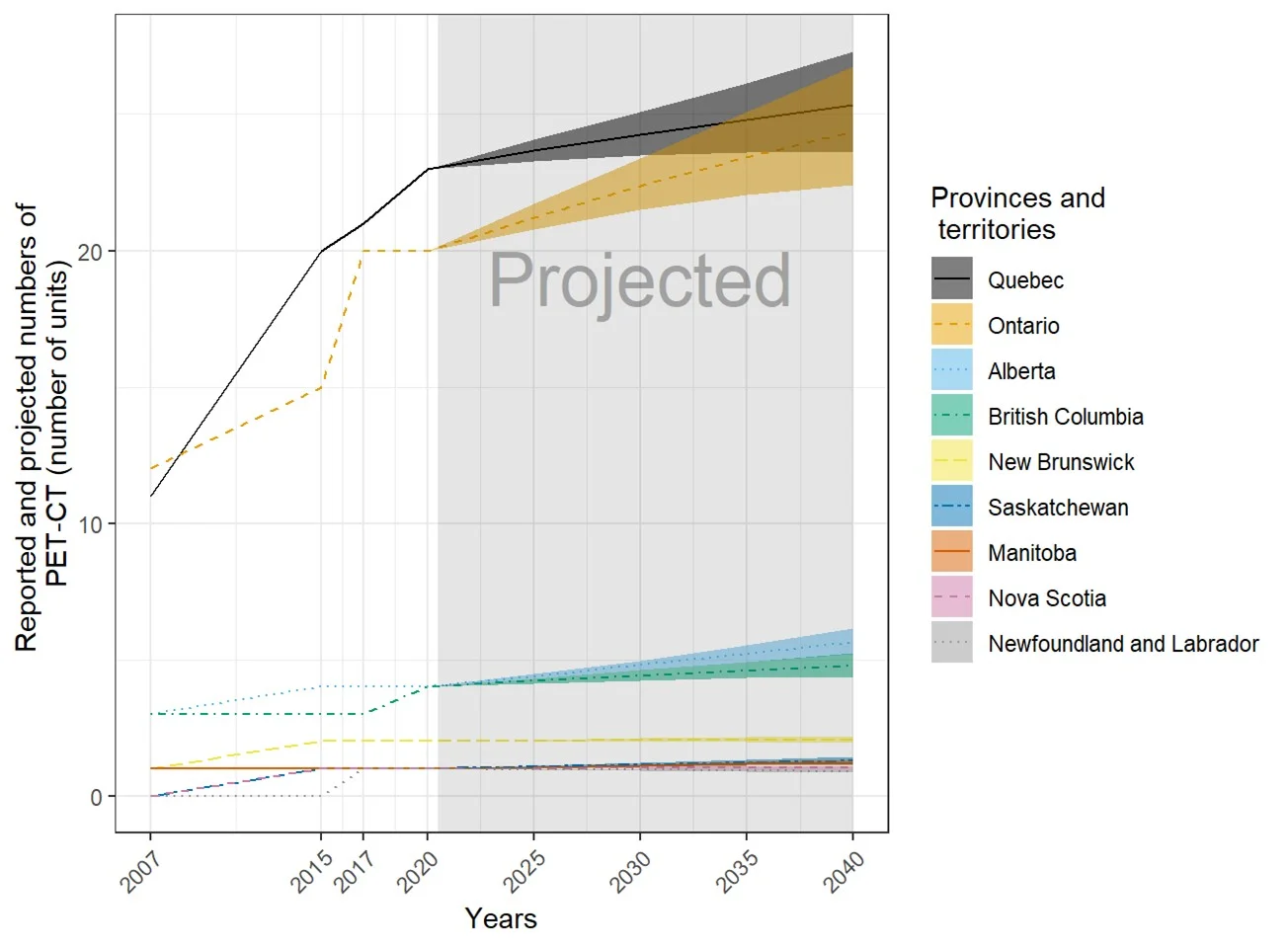

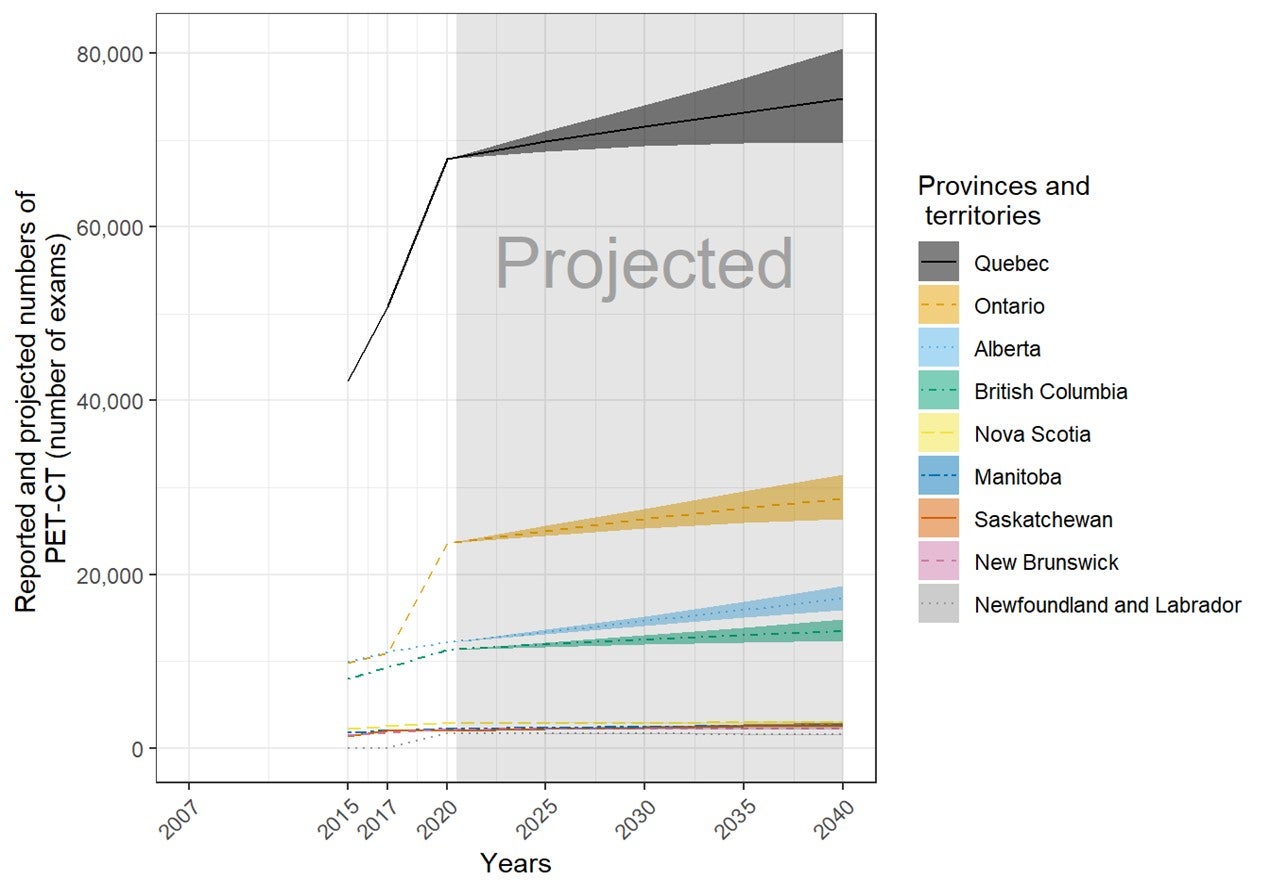

- A total of 57 PET-CT units were identified in Canada, up from 40 in 2010. Nine provinces have at least one unit. Ontario and Quebec have the most units.

- An estimated 125,775 PET-CT examinations were performed in the most recent fiscal year in Canada. This is equivalent to 3.4 exams per thousand people.

- In the next 20 years, the volume of PET-CT exams is anticipated to increase by 16%, based on population projections and current use.

- PET-CT units operate for an average of 43.4 hours per week and 9.0 hours per day. Most PET-CT units do not operate on weekends. PET-CT is primarily used for oncology exams (79%), followed by cardiac and neurological use.

- When the number of PET-CT units per population for Canada is compared with that in other countries that report PET-CT units to the OECD, Canada appears in the lower third of the reported numbers. For the number of exams per population, Canada appears below the midpoint.

- Referring physicians use CDSTs for 26% of PET-CT exams ordered at the point of care.

- Almost one-quarter of PET-CT units are five years old or less, 28% are six to 10 years old, and 33% are 11 to 15 years old.

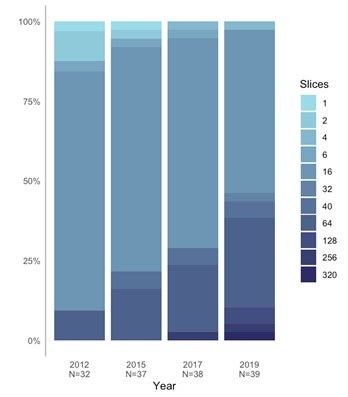

- Half of PET-CT units have 16 slices. The majority of units (90%) are equipped with dose-management controls, and 86% record patient radiation dose by exam.

- The most commonly used isotopes for oncology are fluorine-18–fluorodeoxyglucose (18F-FDG), followed by fluorine-18–sodium fluoride (18F-NaF).

- One-third of sites with PET-CT units have access to a local cyclotron to generate radioisotopes.

Positron Emission Tomography–Magnetic Resonance Imaging

- A total of five PET-MRI units were identified in Canada. Four are located in Ontario, and one unit is in Alberta.

- As PET-MRI is used for research purposes only, we do not have data on clinical examinations or use.

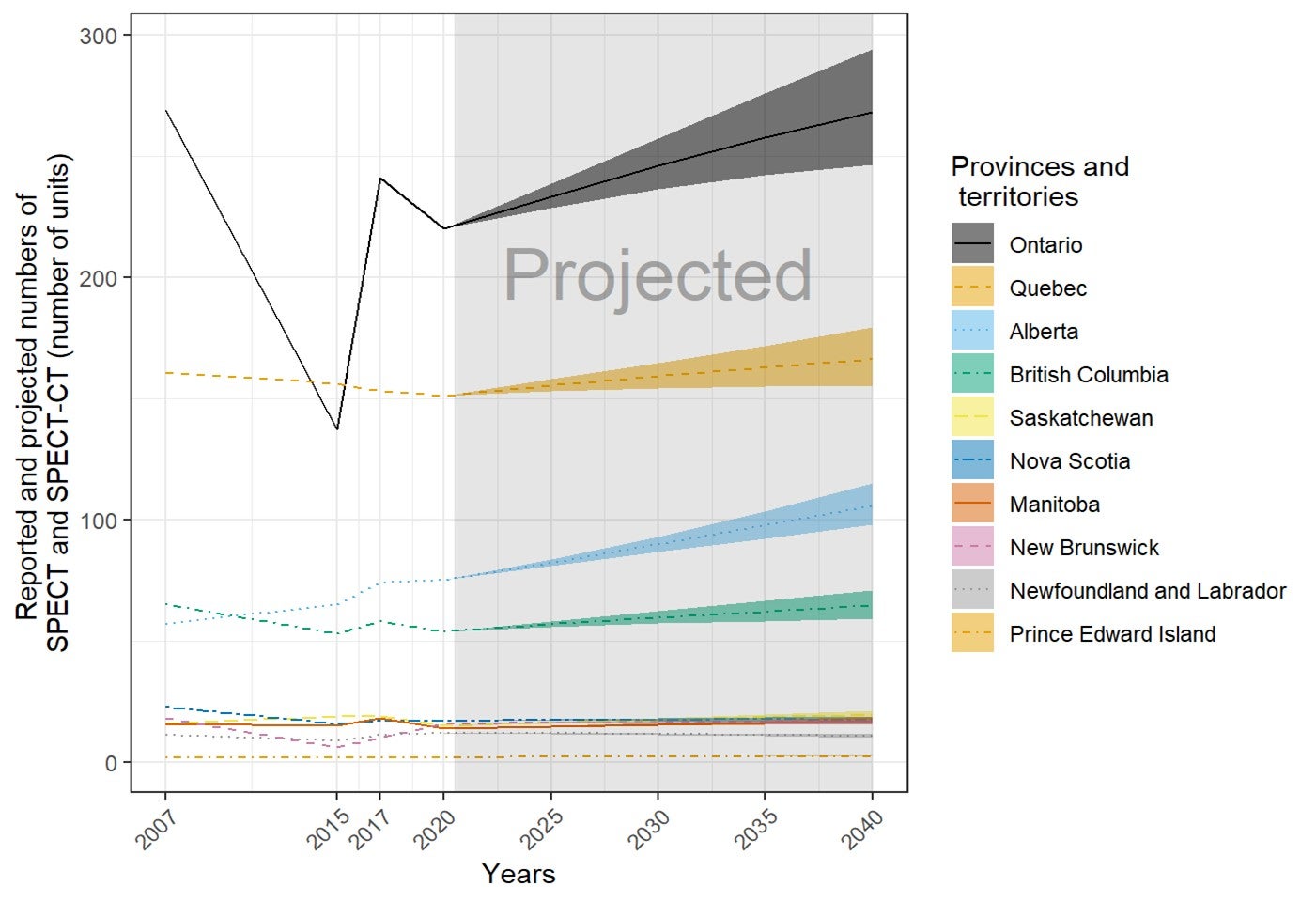

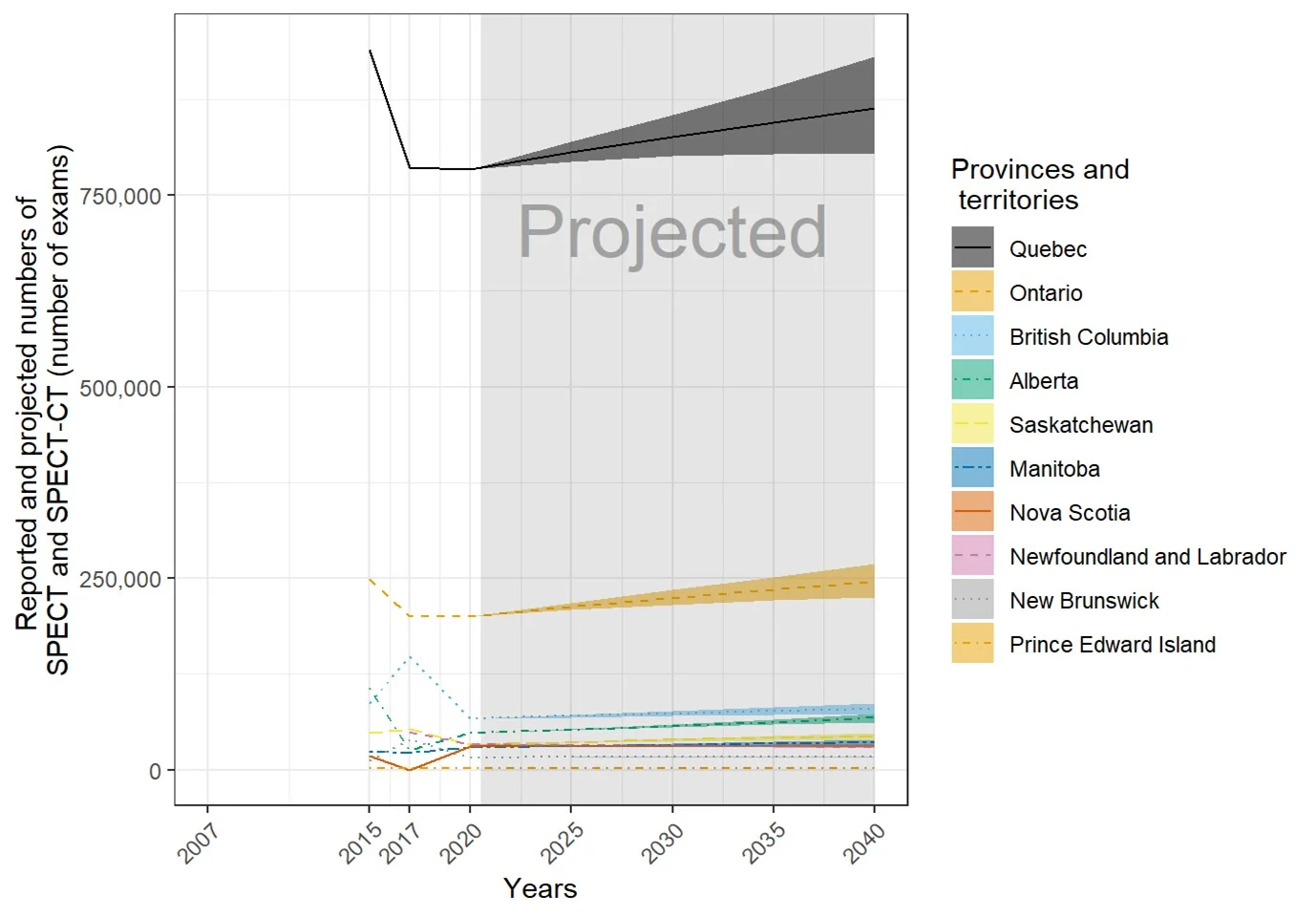

Single-Photon Emission Computed Tomography

- A total of 305 SPECT units were identified in Canada, down from 618 (including gamma cameras) in 2010. Nine provinces have at least one unit. Ontario and Quebec have the most units, followed by Alberta and British Columbia.

- Individual data for SPECT exams were not available for all provinces, so the combined exams are reported under SPECT-CT. Exam data for 2010 were not available.

- SPECT units operate for an average of 43.8 hours per week and 8.9 hours per day. A minority of units operate on weekends. SPECT is primarily used for cardiac examinations (36%), followed by oncology and musculoskeletal exams.

- Most referring physicians do not use CDSTs for SPECT exams ordered at the point of care.

- One-third of SPECT units are 11 to 15 years old, 28% are 16 to 20 years old, 17% are six to 10 years old, and 5% are five years old or less.

- Three-quarters of units have two detector heads, and one-quarter are dedicated cardiac units.

Single-Photon Emission Computed Tomography–Computed Tomography

- A total of 271 SPECT-CT units were identified in Canada, up from 98 in 2010. Ten provinces have at least one unit. Ontario and Quebec have the most units, followed by Alberta and British Columbia.

- A total of 1.2 million SPECT or SPECT-CT exams were carried out in Canada.

- In the next 20 years, the volume of SPECT and SPECT-CT exams is anticipated to increase by 13% based population projections and current use.

- SPECT-CT units operate for an average of 45.6 hours per week and 9.0 hours per day at responding sites. A minority of units operate on weekends. SPECT-CT is primarily used for cardiac examinations (33%), followed by musculoskeletal and oncology exams.

- Most referring physicians do not use CDSTs for SPECT-CT exams ordered at the point of care.

- Almost half of SPECT-CT units are five years old or less, 25% are six to 10 years old, and 24% are 11 to 15 years old.

- Almost all units have two detector heads, two-thirds are equipped with dose-management controls and 67% recorded patient radiation dose by exam. More than two-thirds incorporated image reconstruction techniques for dose reduction.

Picture Archiving and Communication Systems

- Almost one-third (30%) of sites had access to a local or institutional picture archiving and communication system (PACS) network, 30% had access to a regional network, and one-third (39%) had access to a provincial network.

- Almost all sites allow access to PACS images outside the imaging department, and two-thirds allow access to other sites within the provincial health care system.

- Sites with PACS that are geographically close may not necessarily be able to share images, if they are on separate networks with different protocols.

Appropriate Imaging

- Most imaging facilities (84%) have processes in place to determine the appropriateness of orders. Radiologist review of exam orders is the most commonly adopted process.

Limitations

- For feasibility, this iteration of the survey was restricted to six specialist imaging modalities and does not include others that are more common and widespread (e.g., conventional X-ray radiography and ultrasonography).

- As we do not have a definitive list of facilities containing the equipment, and, as the survey was voluntary, we cannot ensure that all facilities or departments containing the modalities were contacted or represented.

- For some survey questions, data were available for only a limited number of sites.

Introduction

In Canada, medical imaging is a vital service within our health care system. It is at the heart of medical practice1 and has transformed the delivery of health care by facilitating the early detection of disease and improving patient outcomes.2,3 Medical imaging has shifted from the study of anatomy alone to the examination of both anatomy and physiology. Information from medical imaging is needed for both acute and non-urgent care, as well as for inpatient and outpatient services.4

CT, MRI, and nuclear medicine imaging, including single-photon emission computed tomography (SPECT) and positron emission tomography (PET), have become commonplace in medical imaging and nuclear medicine departments across Canada. In recent years, hybrid technologies, such as SPECT-CT, PET-CT, and PET-MRI, have further expanded the imaging repertoire. Other recent innovations include techniques that provide higher-quality imaging, lower radiation doses, and faster examinations.5,6

Collectively, these advanced imaging modalities are a significant contributor to the growth in health care costs.7 At the same time, because the rapid diagnosis of patients can reduce further testing and is a step closer to treatment,8 advanced imaging equipment is ultimately associated with decreased long-term health care costs.8 Nonetheless, advanced imaging equipment is expensive,9 especially when considering infrastructure, installation, operating, and ongoing maintenance costs, and, as a result, it often receives special scrutiny.4

As imaging modalities advance, decision-makers and clinicians face complex choices about which medical imaging technologies to acquire and use. Each modality offers unique characteristics, advantages, and disadvantages. However, decisions about adoption and implementation are made within the context of a finite health care budget and limited availability of clinical and technical expertise. In addition, the need for appropriate use of imaging studies has been highlighted by Choosing Wisely Canada10 and Canada Safe Imaging.11 Overuse is associated with unnecessary exposure to radiation, risks of further investigation and treatment arising from false-positive or incidental findings,12 and increased wait times for necessary procedures.13 Wait times can be linked to poorer patient outcomes and may result in reversible conditions worsening, to become chronic, irreversible conditions or permanent disability.14 As well, excessive wait times for CT and MRI are associated with a significant economic burden.15

Coronavirus disease (COVID-19) has exacerbated imaging exam wait times because nonurgent imaging services were postponed during the lockdown in March–April 2020, as a measure to prevent the further spread of COVID-19 and to preserve health system capacity.16 During this period, radiology services experienced a 50% to 70% reduction in volume. While services resumed later in 2020, radiology departments across Canada are challenged with managing a backlog of exams and introducing additional precautions against infection that reduce capacity.16 The survey data captured in this report were collected before the outbreak of COVID-19 and reflect advanced medical imaging in a pre-pandemic environment.

Given these considerations, current information regarding the status of medical imaging equipment in Canada is critical. In 2001, CADTH (then the Canadian Coordinating Office for Health Technology Assessment, CCOHTA) conducted its first inventory of diagnostic imaging equipment in Canada. From 2003 to 2012, CIHI continued to collect data on the inventory and use of diagnostic imaging equipment.17-19 In 2015, CADTH resumed work on the inventory to meet the ongoing need, producing its first report in 201620 and its second report in 2018.21 This updated CMII report summarizes the findings of the 2019–2020 iteration of the inventory.

For this iteration, data were collected on six modalities: CT, MRI, SPECT, PET-CT (which has almost entirely superseded PET), PET-MRI, and SPECT-CT (Appendix 1 describes the modalities and their use.) These six were given priority over several modalities captured in previous iterations of the survey (angiography units, cardiac catheterization units, bone densitometers, and lithotripsy imaging)17-19 and over the widely used modalities of conventional X-ray radiography and ultrasonography. It is considered particularly challenging to collect data on both of these modalities because many exams are performed with hand-held or mobile units. We limited the scope to ensure feasibility, guided by stakeholder prioritization of these six modalities; however, the scope will be re-assessed and expanded in future iterations, if feasible. Data were also captured on infrastructure requirements of current concern:

- use of and access to a PACS for each of the six modalities

- adoption of artificial intelligence (AI)

- requisition practices of referring physicians

- source and use of various isotopes for PET and its hybrid modalities.

Objectives

The purpose of this pan-Canadian inventory is to document current practices and developments in the supply, distribution, technical operation, and general clinical use of selected medical imaging modalities at public and private Canadian health care facilities. The overall objectives of the project are the following:

- to determine the number of units (medical imaging devices) for selected medical imaging modalities in Canada

- to provide accurate and timely data on the supply, distribution, and use of selected medical imaging units in Canada

- to improve current understanding of the technical characteristics of medical imaging equipment in Canada

- to report on trends and developments in the use of medical imaging equipment across Canada

- to inform medical imaging–related strategic planning on a national, provincial, or territorial basis.

Methods

Identification of Respondents and Data Collection

Data Sources

Data were primarily collected via a web-based survey on the CADTH website. (The English-language survey is shown in Appendix 2.) Both English- and French-language versions were offered. The 2019–2020 survey was based on the 2017 iteration of the survey, with the following changes:

- Questions added

- the estimated percentage of operational revenue sourced from private insurers or out-of-pocket patient payments for facilities that were privately funded or received a mix of private and public funding (not applicable for public sites)

- whether a unit was a replacement for a decommissioned unit or a first-time installation for the site

- the number of cone beam CT units

- whether patient cumulative radiation dose tracking is used for CT, PET-CT, and SPECT-CT units; if not, whether patient cumulative radiation tracking is planned for the future

- scheduled downtime of imaging modalities for maintenance and unplanned maintenance time, in hours per year

- the number of full-time imaging medical radiation technologists (MRTs) in radiology departments

- breakdown of use among diagnostic, interventional, research, and other purposes in percentages of time for imaging units by modality type

- whether AI, electronic CDSTs, peer review programs, centralized order entry systems, and automated entry forms have been adopted for imaging units

- whether paper forms are used when ordering exams for imaging units; whether exam requests are sent by fax or by telephone

- the type of equipment servicing options for imaging units

- breakdown of the type and use of PET radiotracers

- breakdown of the types of processes used to determine the appropriateness of exams.

Survey respondents who had participated in previous iterations of the inventory were presented with pre-populated forms for updating and completion. Respondents for new sites were identified by validators and other imaging professionals and were provided with blank forms. Data for pre-population were obtained from the following sources:

- site-level data from the CMII 2017 survey, including site survey responses, supplemented by data validators, and a supplementary grey literature search conducted for the 2017 report

- unit-level (technical) data from the CMII 2017 survey, for units installed between 2012 and 2017

- unit-level data from the CIHI 2012 dataset, for units installed before 2012; site-level data were not carried forward

- unit-level availability data provided by three major suppliers of diagnostic imaging equipment (Toshiba, Siemens, and GE) in 2017.

The CMII 2017 final dataset was restructured and merged with the new data. Differences in site names, unit technical specifications, and dates of installation were reconciled manually across data sources. Site names, year of decommission, and first year of operation of imaging equipment, in particular, were inconsistent across sources. Sites with name changes were updated and verified via web searches and/or by contacting the facility directly. If the data source offered a year of installation but did not indicate the first year of operation, then the first year of operation was assumed to be the year following installation.

Site-level data consisted of unit availability and counts by modality, and the following metrics by modality:

- total number of exams in the last fiscal year across all units (some sites had only the last calendar year available, and reported that)

- use of AI

- CDST

- planned and unplanned downtime for maintenance

- use of paper forms or telephone requests or fax requests

- numbers of full-time equivalent technologists (collectively for units of the same type).

Site-level data also included the type of facility, the use of PACS, and proportions of private funding. Unit-level information consisted of manufacturer, model, and year of installation, as well as modality-specific technical characteristics, such as the average hours of use per day and per week through regular scheduled service capacity, 24-hour and weekend use, equipment downtime, the source of isotopes (for PET-CT or PET-MRI), number of detectors/slices for CT, field strength for MRI, breakdowns of types of use into categories, the integration of AI, peer review programs, order entry practices, and equipment servicing arrangements.

Survey respondents for 2019–2020 were asked to update the available data to reflect the status as of the time of survey response. In particular, survey respondents were asked to identify units that had been decommissioned, regardless of the year, and to provide the year of decommissioning. If survey respondents did not update the survey, it was assumed that no changes had been made from the 2017 survey. This assumption was specifically mentioned to survey respondents when the final survey reminder was sent to facilities that had not already submitted the survey. The survey form also included a field to invite respondents to give additional detail, from which we extracted information regarding decommissioning activities, discrepancies between planned and unplanned downtime of equipment, descriptions of AI use, PET-CT information on cyclotrons and radiotracers, and sharing of mobile units.

Data from validators for unit counts and examinations in the last fiscal year were preferentially used over survey data; validator data were also used to calculate unit counts per population and exams per population. Data from 2017 were used for the number of units and exams when provincial validated data were not available. For equipment dates, validators sometimes reported slightly different periods than those documented in this report (2019–2020). This often depended on the availability of regional or provincial level data at the time of reporting or for specific reporting periods. Site-level unit counts supplied by validators were used to identify missing or surplus units in the database (duplicates or decommissioned units that had not been identified as such, the assumption being that the oldest unit or units were the ones decommissioned). In some instances, validators updated some site-level data up until October 28, 2020. Validators were also requested to identify the following:

- which health care professionals can order imaging exams for each of the different imaging modalities

- sources of funding

- drivers of jurisdictional decisions around replacing, upgrading, or adding new imaging equipment

- criteria used when expanding imaging modalities into new geographic locations

- the approximate length of time it takes to review proposals for new equipment in sites

- the percentage of exams conducted in the private setting

- whether teleradiology services were used.

In some instances, validators also updated this provincial and or regional data up until October 28, 2020.

Identification of Potential Respondents

Most respondents were identified in advance from a database of previous participants. These contacts were updated to account for changes due to position turnover, retirement, and restructuring. Potential respondents included individuals working in private or public health care settings that operate medical imaging equipment. Occupations included executive (e.g., president of a private facility, hospital administrator) and leadership positions (e.g., chief technologist, manager or director of diagnostic imaging, site coordinator). Some respondents were identified through CADTH liaison officers, external stakeholders, and participant referrals. Respondents for new private facilities were identified by cross-referencing provincial documents, conducting web searches, and contacting facilities directly.

Passive methods of recruitment included promoting the renewed survey on the CADTH website and by word of mouth. As well, several associations such as the Canadian Association of Radiologists (CAR), the Canadian Association of Medical Radiation Technologists, and the Canadian Organization of Medical Physicists promoted the survey via outreach to their membership and/or mention in newsletters.

To access the survey, all participants were asked to register a profile on the CADTH website to ensure their response was linked to a unique registration profile. Registrants were matched to sites if there was a pre-existing record, or, if there was no pre-existing record, were presented with a blank form to create a new record.

Duration of Survey

The survey opened on November 27, 2019, and data collection closed on February 11, 2020. In some instances, validators updated some site-level data, as well as provincial and/or regional level data, up until October 28, 2020.

Validation

When the survey closed on February 11, 2020, we created summary statistics of the number of units per modality in each jurisdiction. The summary statistics were reviewed by identified validators. Depending on the jurisdiction, each validator reviewed data for an entire province or territory, or for one or more health regions within a province. Validators assessed the summaries for accuracy and provided corrections and information on non-respondents (unit counts or examinations, either at a site or jurisdictional level). Validators were also asked to encourage non-respondents in their regions to participate in the survey by the extended deadline of February 14, 2020.

Validators also provided unit counts and examination volume data for their jurisdiction (province or region). Validators were also given an early draft of the report to confirm the main findings. In some instances, validators adjusted site-level data.

Identified stakeholders and validators were given the opportunity to review a draft report during a stakeholder feedback process. The report underwent two rounds of internal review and a formal peer review process before it was published.

Data Analysis

Data sources used in the CMII other than the survey and validator responses are presented in Table 1, and use of the datasets in the analysis, in Table 2.

Table 1: Additional Data Sources Used in the CMII

| Data source | Application of data |

|---|---|

| Industry data | From GE, Siemens, and Toshiba, we obtained a list of installed equipment and upgrades. |

| Canadian population data and projections | From Statistics Canada, we obtained population data and projections for Canada and the provinces. |

| International comparison data | From the OECD website, we obtained international comparison data for the number of units and examinations for CT, MRI, and PET. |

CT = computed tomography; MRI = magnetic resonance imaging; OECD = Organisation for Economic Co-operation and Development;

PET = positron emission tomography.

Table 2: Use of Datasets in Analyses

| Data summaries | Data sources | ||||||

|---|---|---|---|---|---|---|---|

| CMII 2019–2020 survey | CMII 2017 survey |

CMII 2015 surveya,b | CIHI 2012 datac | Validation data | Statistics Canada | International datad | |

| Summaries of site characteristics |

⦿ |

⦿ |

⦿ |

|

|

|

|

| Summaries of modality availability, number of units |

⦿ |

⦿ |

⦿ |

|

⦿ |

|

|

| Summary of planned installations and planned decommissioning |

⦿ |

⦿ |

|

|

|

|

|

| Summary of units at sites that had responses to the 2015 survey but no responses or validation data for the CMII 2017 surveya |

|

|

⦿ |

|

|

|

|

| Maps of machine locations |

⦿ |

⦿ |

⦿ |

|

⦿ |

|

|

| Summaries of exams in one fiscal year |

⦿ |

⦿ |

⦿ |

|

⦿ |

|

|

| Summaries of average hours per week and hours per day of operation, summaries of proportions of types of use |

⦿ |

⦿ |

⦿ |

|

|

|

|

| Summaries of units per site and units per population |

⦿ |

⦿ |

⦿ |

|

⦿ |

⦿ |

|

| Comparisons of inventory with international availability for CT, MRI, and PET-CT |

⦿ |

⦿ |

⦿ |

|

⦿ |

|

⦿ |

| Age of units, current and decommissioned |

⦿ |

⦿ |

⦿ |

⦿ |

|

|

|

| Technical specifications of current units |

⦿ |

⦿ |

⦿ |

⦿ |

|

|

|

CADTH = Canadian Agency for Drugs and Technologies in Health; CIHI = Canadian Institute for Health Information; CMII = Canadian Medical Imaging Inventory;

CT = computed tomography; MRI = magnetic resonance imaging.

a Sites that had a response to the 2015 survey, but not the 2017 survey, identified by the lack of a submission form for the 2017 survey or of correspondence indicating no change or describing changes.

b These data included responses from site survey responses, supplemented by data validators, and a supplementary grey literature search conducted for the 2015 report.

c From the dataset originally supplied to CADTH by the Canadian Institute for Health Information, consisting of data collected between 2003 and 2012, as described in the 2015 CMII report.11

d International data from the OECD.12-15

Data Summaries

We present the data using descriptive summaries and graphs of site- and province-level findings. We use counts for discrete data, such as the number of sites with a given modality or the number of units at a site. Continuous values are presented either as summary statistics such as mean (average), or range between minimum and maximum values, or as assigned categories (e.g., hours of use per day as less than eight hours, eight to less than 12 hours, 12 to less than 18 hours, and 18 hours or more). Where we asked respondents to choose between two or more responses (e.g., yes/no), we report the counts and/or percentages of respondents who selected each response. Stacked bar charts were used to display number of units and hours and percentage of use as categories. The geographical distribution of modalities was presented on maps using geocoded data.

International Comparison

The total or per capita number of units and exams of three imaging modalities — CT, MRI, and PET — from OECD countries22 was plotted, together with the data from the CMII 2020 survey, in diverging dot plots, with the values from the most recent years labelled. To demonstrate the time trends in the OECD countries, historical values were also plotted with dots in lighter shades. Canada’s ranking among OECD countries was reported.

Future Projections of the Numbers of Units and Exams for Canadian Provinces and Territories

The number of units and exams was projected for the years 2025, 2030, 2035, and 2040, based on the per capita values in 2020 and the projected population sizes provided by Statistics Canada. Projected population sizes were based on high-, median-, and low-growth assumptions. Median units and exams were projected based on median growth, and upper and lower limits were based on the high- and low-growth assumptions. The number of units and exams per capita was assumed to remain the same in 2025, 2030, 2035, and 2040.15 The projections are based on jurisdiction-wide population data and did not reflect projected growth in specific areas within a jurisdiction. This simplified assumption was similar to the one made by the Conference Board of Canada.15

Missing Data and Imputation

Handling of Data from Sites Without Updated Data in 2019–2020

If the 2019–2020 survey was not updated for a site, we assumed there was no change from 2017 data. We carried forward data from previous surveys according to the following rules:

- Data for site characteristics, PACS use, unit and modality availability, exam counts, technical information, and use collected during the CMII 2017 survey were carried forward unchanged.

- Data for unit technical specifications collected up to 2012 were used in data summaries for age and technical information, provided the unit had not been identified as surplus to validated counts.

- Data for site characteristics, PACS use, unit and modality availability and counts, and modality use collected up to 2012 were not incorporated into data summaries unless they were confirmed in 2015, 2017, or 2019 (e.g., for unit counts, by comparing with validators’ data).

Imputing Missing Data

We imputed data for a limited number of missing values. In particular, if the questions regarding planned installations or decommissioning were left blank, we assumed the answer was “no.” If the completed use categories added up to 100%, then any missing values were assumed to be 0%. Out-of-range values for the number of hours of operation per week (> 168 hours) or per day (> 24 hours) were set to “missing.”

Results

Response Rate for the 2019–2020 Update

Overall, data from 455 sites were used to inform the findings of this report. Updated or new survey responses were received for at least 244 sites. Provincial and territorial validators provided information for nonresponding publicly funded health facilities. Data obtained from the 2017 CMII survey and from other sources, such as information received via personal communications or from the websites of health care facilities, were used to inform the status of the remaining sites. At least minimal data (modalities and unit counts) were available for a total of 455 sites. By comparison, 222 and 370 completed initial surveys were received for the 2015 and 2017 CMII, respectively.

Characteristics of Facilities Responding to the 2019–2020 Update

Of the 401 sites with known facility type, most were identified as hospitals, accounting for 222 (55.2%) of reported sites, while 57 (14.2%) were community hospitals, 92 (22.9%) were free-standing facilities, and 31 (8.2%) were tertiary care centres. (Table 83, shows summaries by province or territory.) A facility was defined as a single hospital or hospital campus site that was part of an amalgamation of hospitals. The definition of free-standing facility was broad and captured mainly privately funded facilities and some publicly funded sites, as well as sites that received both types of funding. See Appendix 2 for the detailed definitions of facility type.

Of the 361 sites that provided setting information, most (264 [73.1%]) were urban, while 87 (24.1%) were rural, and 10 (2.8%) were remote. (Table 84, shows summaries by province or territory.)

Of the 401 sites that provided funding information, most (309 [77.1%]) were publicly funded, while 77 (19.2%) were privately funded, and 15 (3.7%) received both public and private funding (Table 85 shows summaries by province or territory).

Overall Inventory of Medical Imaging Equipment in Canada in 2019–2020

In this section, we briefly describe the overall reported inventory of units and use for the six imaging modalities of interest across all provinces and territories. Subsequent sections present in greater detail the inventory and use for CT, MRI, PET-CT, PET-MRI, SPECT, and SPECT-CT.

Total Unit Count

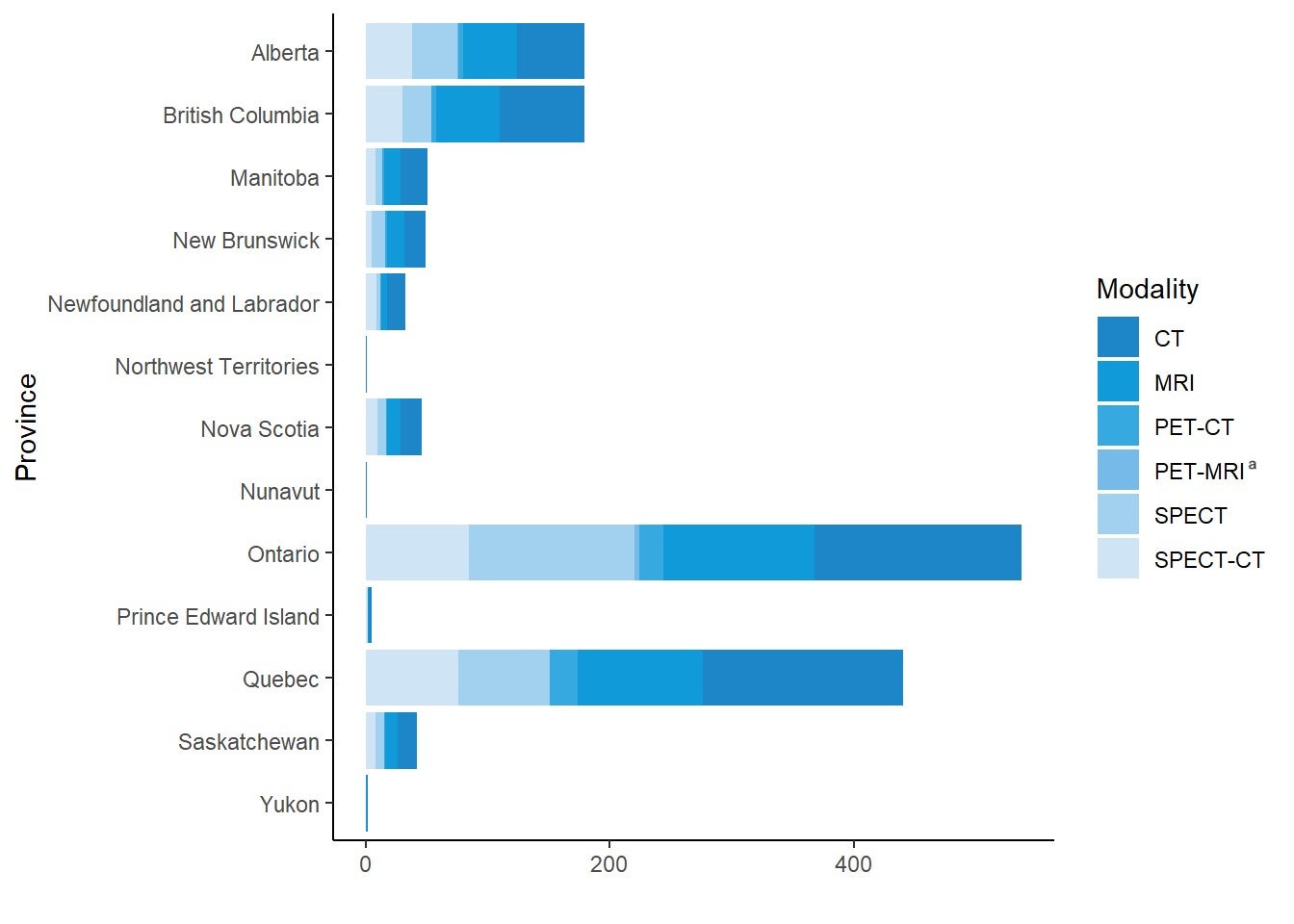

Figure 1 and Table 3 show the overall provincial and territorial inventory of all six modalities.

Table 3 shows the total number of units per modality for each jurisdiction, as well as the number of sites where that modality is available. This information is drawn from the survey responses, validators’ counts, and additional units identified in the CIHI 2012 survey data as free-standing facilities. The five PET-MRI units in Alberta and Ontario are used for research purposes only.

Table 3: Overall Provincial or Territorial Inventory and Availability of CT, MRI, PET-CT, PET-MRI, SPECT, and SPECT-CT for Public and Private Facilities in 2019–2020

| CT | MRI | PET-CT | PET-MRIa | SPECT | SPECT-CT | |

|---|---|---|---|---|---|---|

| Number of unitsb(number of sites with units)c | ||||||

| Alberta | 55 (43) | 44 (34) | 4 (3) | 1 (1) | 37 (25) | 38 (24) |

| British Columbia | 69 (46) | 52 (45) | 4 (3) | 0 (0) | 24 (19) | 30 (19) |

| Manitoba | 22 (16) | 14 (8) | 1 (1) | 0 (0) | 6 (4) | 8 (4) |

| New Brunswick | 17 (11) | 14 (10) | 2 (2) | 0 (0) | 11 (5) | 5 (5) |

| Newfoundland and Labrador | 15 (14) | 5 (5) | 1 (1) | 0 (0) | 3 (3) | 9 (4) |

| Northwest Territories | 1 (1) | 0 (0) | 0 (0) | 0 (0) | 0 (0) | 0 (0) |

| Nova Scotia | 17 (14) | 11 (10) | 1 (1) | 0 (0) | 7 (7) | 10 (8) |

| Nunavut | 1 (1) | 0 (0) | 0 (0) | 0 (0) | 0 (0) | 0 (0) |

| Ontario | 169 (107) | 124 (75) | 20 (16) | 4 (4) | 135 (68) | 85 (50) |

| Prince Edward Island | 2 (2) | 1 (1) | 0 (0) | 0 (0) | 0 (0) | 2 (1) |

| Quebec | 164 (100) | 102 (91) | 23 (18) | 0 (0) | 75 (38)d | 76 (40)d |

| Saskatchewan | 16 (13) | 10 (8) | 1 (1) | 0 (0) | 7 (4) | 8 (5) |

| Yukon | 1 (1) | 1 (1) | 0 (0) | 0 (0) | 0 (0) | 0 (0) |

| Canada | 549 (369) | 378 (288) | 57 (46) | 5 (5) | 305 (174) | 271 (160) |

CT = computed tomography; MRI = magnetic resonance imaging; PET = positron emission tomography; PET-CT = positron emission tomography–computed tomography; PET-MRI = positron emission tomography–magnetic resonance imaging; SPECT = single-photon emission computed tomography; SPECT-CT = single-photon emission computed tomography–computed tomography.

a PET-MRI is used only for research purposes.

b Per-province unit counts according to the validator and responses from private sites.

c Per-province unit availability according to the validator if the validator provided lists of sites with availability; where these were unavailable, the data were from the survey.

d Validator-supplied combined unit counts for SPECT and SPECT-CT. Distribution was assumed to be approximately 50:50, based on the division in Quebec and overall.

Figure 1: Overall Provincial or Territorial Inventory of CT, MRI, PET or PET-CT, PET-MRI, SPECT, and SPECT-CT

CT = computed tomography; MRI = magnetic resonance imaging; PET = positron emission tomography; PET-CT = positron emission tomography–computed tomography; PET-MRI = positron emission tomography–magnetic resonance imaging; SPECT = single-photon emission computed tomography; SPECT-CT = single-photon emission computed tomography–computed tomography.

a PET-MRI is used only for research purposes.

Number of Units by Provincial or Territorial Population

Table 4 shows the number of units reported per million people for all provinces and territories and for Canada as a whole. The five PET-MRI units located in Alberta and Ontario are used for research purposes only.

Table 4: CT, MRI, PET-CT, PET-MRI, SPECT, and SPECT-CT Units per Million Provincial or Territorial Population in 2019–2020

| Province or territory | Population | CT | MRI | PET-CT | PET-MRIa | SPECT | SPECT-CT |

|---|---|---|---|---|---|---|---|

| Number of unitsb per million populationc | |||||||

| Alberta | 4,395,586 | 12.5 | 10 | 0.9 | 0.2 | 8.4 | 8.6 |

| British Columbia | 5,105,576 | 13.5 | 10.2 | 0.8 | 0 | 4.7 | 5.9 |

| Manitoba | 1,373,859 | 16 | 10.2 | 0.7 | 0 | 4.4 | 5.8 |

| New Brunswick | 780,021 | 21.8 | 17.9 | 2.6 | 0 | 14.1 | 6.4 |

| Newfoundland and Labrador | 521,922 | 28.7 | 9.6 | 1.9 | 0 | 5.7 | 17.2 |

| Northwest Territories | 44,895 | 22.3 | 0 | 0 | 0 | 0 | 0 |

| Nova Scotia | 976,768 | 17.4 | 11.3 | 1 | 0 | 7.2 | 10.2 |

| Nunavut | 38,873 | 25.7 | 0 | 0 | 0 | 0 | 0 |

| Ontario | 14,659,616 | 11.5 | 8.5 | 1.4 | 0.2 | 9.2 | 5.8 |

| Prince Edward Island | 157,901 | 12.7 | 6.3 | 0 | 0 | 0 | 12.7 |

| Quebec | 8,522,800 | 19.2 | 12 | 2.7 | 0 | 8.8 | 8.9 |

| Saskatchewan | 1,178,657 | 13.6 | 8.5 | 0.8 | 0 | 5.9 | 6.8 |

| Yukon | 41,022 | 24.4 | 24.4 | 0 | 0 | 0 | 0 |

| Canada | 37,797,496 | 14.5 | 10 | 1.5 | 0.1 | 8.1 | 7.2 |

CT = computed tomography; MRI = magnetic resonance imaging; PET = positron emission tomography; PET-CT = positron emission tomography–computed tomography; PET-MRI = positron emission tomography–magnetic resonance imaging; SPECT = single-photon emission computed tomography; SPECT-CT = single-photon emission computed tomography–computed tomography.

a PET-MRI is used for research purposes only.

b Per-province unit counts according to the validator.

c The population (estimated) as of fourth quarter, 2019.23

Overall Number of Examinations

Table 5 shows the total number of examinations reported for all modalities across Canada for the most recent fiscal (or calendar) year. Data from validators are reported and are supplemented with data from private facilities where available. In Ontario, the 2020 validator data were not available for SPECT and SPECT-CT, and the 2017 CMII data were labelled in the table. Several jurisdictions combined SPECT and SPECT-CT exam data; therefore, an aggregated total is reported for these two modalities. A total of 1,200 exams were reported by a single site with PET-MRI. However, all PET-MRI exams are conducted for research purposes only.

Table 5: Total Examinations for the Latest Fiscal (or Calendar) Year for All Modalities Across Canada for Public and Private Facilities in 2019–2020

| Province or territory | CT | MRI | PET-CT | PET-MRIa | SPECT and SPECT-CT |

|---|---|---|---|---|---|

| Numbers of exams | |||||

| Albertab | 449,433 | 215,593 | 12,175 | 0 | 47,858 |

| British Columbia | 805,584 | 255,038 | 11,286 | 0 | 66,604 |

| Manitoba | 240,269 | 95,250 | 2,180 | 0 | 29,400 |

| New Brunswickb | 162,322 | 46,309 | 2,149 | 0 | 16,219 |

| Newfoundland and Labradorb | 98,967 | 21,929 | 1,704 | 0 | 33,095 |

| Nortdwest Territories | 5,789 | 0 | 0 | 0 | 0 |

| Nova Scotia | 170,603 | 50,664 | 2,818 | 0 | 30,235 |

| Nunavut | 3,081 | 0 | 0 | 0 | 0 |

| Ontario | 1,842,982 | 1,107,814 | 23,564 | 1,200 | 200,833 c |

| Prince Edward Islandb | 19,349 | 5,348 | 0 | 0 | 2,129 |

| Quebecb | 1,491,087 | 448,130 | 67,849 | 0 | 783,667 |

| Saskatchewanb | 124,918 | 81,652 | 2,050 | 0 | 33,723 |

| Yukon | 5,437 | 2,496 | 0 | 0 | 0 |

| Canada | 5,419,821 | 2,330,223 | 125,775 | 1,200 | 1,243,763 |

CT = computed tomography; MRI = magnetic resonance imaging; PET = positron emission tomography; PET-CT = positron emission tomography–computed tomography; PET-MRI = positron emission tomography–magnetic resonance imaging; SPECT = single-photon emission computed tomography; SPECT-CT = single-photon emission computed tomography–computed tomography.

a PET-MRI exams are conducted for research purposes only.

b Fiscal year 2018–2019.

c These are 2017 data.

Table 6 shows the per capita number of examinations reported for all modalities.

Table 6: Exams per thousand Population by Modality and Province/Territory

| Province or territory | Populationa | CT | MRI | PET-CT | PET-MRIb | SPECT and SPECT-CT |

|---|---|---|---|---|---|---|

| Exams per thousand population | ||||||

| Albertac | 4,395,586 | 102.2 | 49.0 | 2.8 | 0.0 | 10.9 |

| British Columbia | 5,105,576 | 157.8 | 50.0 | 2.2 | 0.0 | 13 |

| Manitoba | 1,373,859 | 174.9 | 69.3 | 1.6 | 0.0 | 21.4 |

| New Brunswickc | 780,021 | 208.1 | 59.4 | 2.8 | 0.0 | 20.8 |

| Newfoundland and Labradorc | 521,922 | 189.6 | 42.0 | 3.3 | 0.0 | 63.4 |

| Northwest Territories | 44,895 | 128.9 | 0.0 | 0.0 | 0.0 | 0 |

| Nova Scotia | 976,768 | 174.7 | 51.9 | 2.9 | 0.0 | 31 |

| Nunavut | 38,873 | 79.3 | 0.0 | 0.0 | 0.0 | 0 |

| Ontario | 14,659,616 | 125.7 | 75.6 | 1.6 | 0.1 | 13.7 |

| Prince Edward Islandc | 157,901 | 122.5 | 33.9 | 0.0 | 0.0 | 13.5 |

| Quebecc | 8,522,800 | 175.0 | 52.6 | 8.0 | 0.0 | 91.9 |

| Saskatchewanc | 1,178,657 | 106.0 | 69.3 | 1.7 | 0.0 | 28.6 |

| Yukon | 41,022 | 132.5 | 60.8 | 0.0 | 0.0 | 0 |

| Canada | 37,797,496 | 143.4 | 61.6 | 3.3 | 0.0 | 32.9 |

CT = computed tomography; MRI = magnetic resonance imaging; PET = positron emission tomography; PET-CT = positron emission tomography–computed tomography; PET-MRI = positron emission tomography–magnetic resonance imaging; SPECT = single-photon emission computed tomography; SPECT-CT = single-photon emission computed tomography–computed tomography.

a The population (estimated) as of fourth quarter, 2019.23

b PET-MRI exams are conducted for research purposes only.

c Fiscal year 2018–2019.

Sources of Funding

Survey participants were asked to report the source of funding for each site. Among the 401 sites that reported the sources of funding, 309 (77.1%) sites reported that they were publicly funded, 77 (19.2%) sites were privately funded, and 15 (3.7%) sites receiving funds from both public and private sources. A summary of provincial and territorial facility funding is provided in Table 7.

Private facilities were asked to report on the estimated percentage of operating revenue sourced from out-of-pocket payments or private insurance. Nine out of 92 sites that received private funding provided data and reported receiving on average 53.4% (range 2% to 100%) of their overall revenue from these funding sources.

Table 7: Summary of Source of Funding for Sites Included in the Canadian Medical Imaging Inventory 2019–2020 Update

| Province or territory | Publicly | Privately | Both | Not reported |

|---|---|---|---|---|

| Number of sites (%) | ||||

| Alberta | 43 (62.3) | 22 (31.9) | 4 (5.8) | 0 (0) |

| British Columbia | 53 (73.6) | 15 (20.8) | 2 (2.8) | 2 (2.8) |

| Manitoba | 17 (100) | 0 (0) | 0 (0) | 0 (0) |

| New Brunswick | 9 (75) | 1 (8.3) | 0 (0) | 2 (16.7) |

| Newfoundland and Labrador | 14 (100) | 0 (0) | 0 (0) | 0 (0) |

| Northwest Territories | 14 (93.3) | 1 (6.7) | 0 (0) | 0 (0) |

| Nova Scotia | 1 (100) | 0 (0) | 0 (0) | 0 (0) |

| Nunavut | 0 (0) | 0 (0) | 0 (0) | 1 (100) |

| Ontario | 90 (72) | 9 (7.2) | 3 (2.4) | 23 (18.4) |

| Prince Edward Island | 2 (100) | 0 (0) | 0 (0) | 0 (0) |

| Quebec | 53 (42.4) | 28 (22.4) | 4 (3.2) | 40 (32) |

| Saskatchewan | 12 (75) | 1 (6.2) | 2 (12.5) | 1 (6.2) |

| Yukon | 1 (100) | 0 (0) | 0 (0) | 0 (0) |

| Canada | 309 (65.7) | 77 (16.4) | 15 (3.2) | 69 (14.7) |

Overall Summary of Use: Hours per Day and Hours per Week

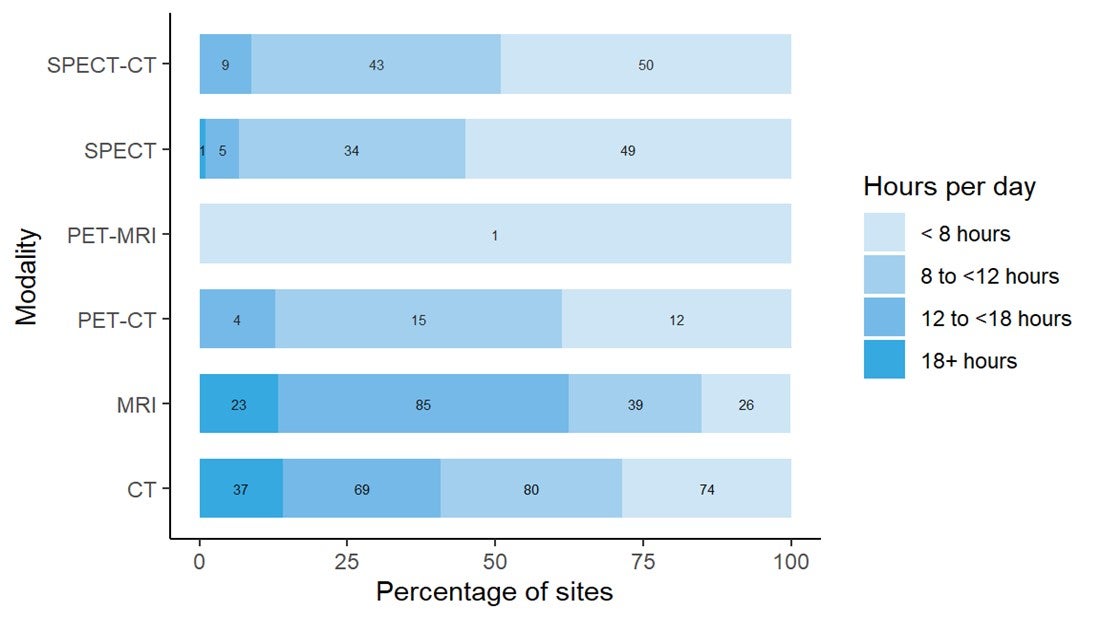

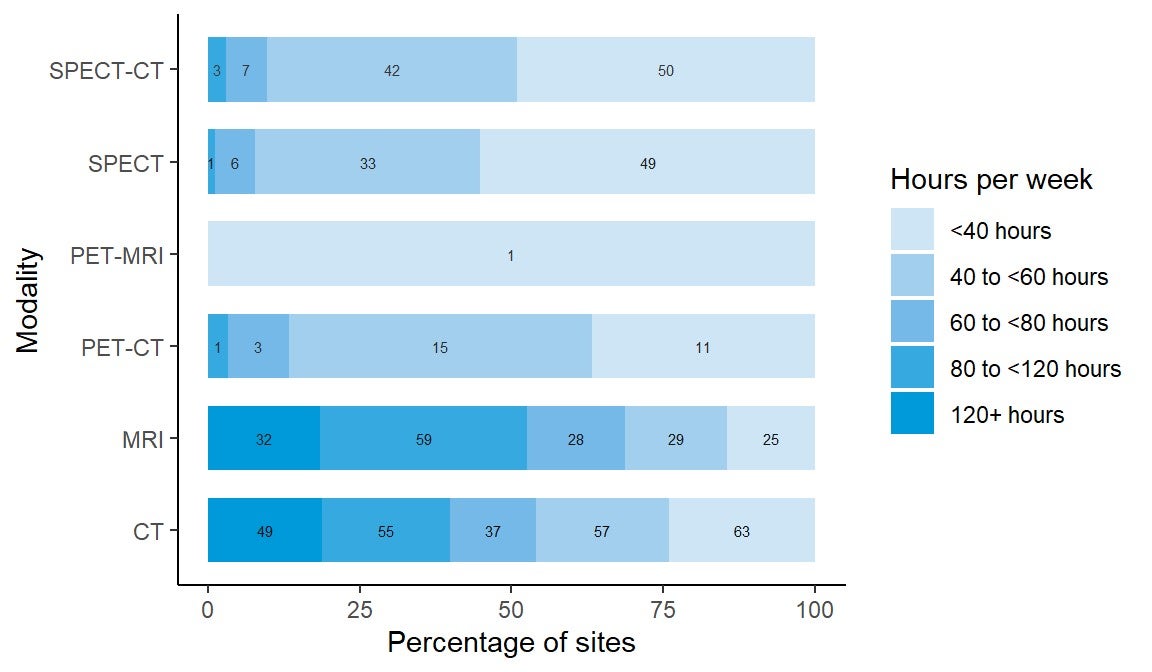

Figure 3 show the pattern of use by hours per day and hours per week, as well as by number and percentage of units, per modality for all available units in the public setting. The graph depicts the percentage of sites with units used less than eight hours a day, eight to less than 12 hours per day, 12 to less than 18 hours per day, and greater than 18 hours per day, and the bars are labelled with the number of sites in each category. The most heavily used modality is CT, followed by MRI.

Figure 2: Daily Use of Diagnostic Imaging Equipment in Hours by Percentages of Sites

CT = computed tomography; MRI = magnetic resonance imaging; PET = positron emission tomography; PET-CT = positron emission tomography–computed tomography; PET-MRI = positron emission tomography–magnetic resonance imaging; SPECT = single-photon emission computed tomography; SPECT-CT = single-photon emission computed tomography–computed tomography.

Note: Data derived from the survey question: “In an average 24-hour workday, how many hours are the [modality] units staffed through regular scheduled service capacity (do not include hours where staff are only on call)?” Where 2019–2020 data were not available, 2017 data were used, where available. Sites without data from 2017 or 2019–2020 were not included in the figures. Bars are labelled with the number of sites in each category.

Figure 3: Weekly Use of Diagnostic Imaging Equipment in Hours by Percentages of Sites

CT = computed tomography; MRI = magnetic resonance imaging; PET = positron emission tomography; PET-CT = positron emission tomography–computed tomography; PET-MRI = positron emission tomography–magnetic resonance imaging; SPECT = single-photon emission computed tomography; SPECT-CT = single-photon emission computed tomography–computed tomography.

Note: Data derived from the survey question: “In an average 168-hour week, how many hours are the [modality] units staffed through regular scheduled service capacity (do not include hours where staff are only on call)?” Where 2019–2020 data were not available, 2017 data were used, where available. Otherwise, no imputation was done, and the site was not included in the totals. Bars are labelled with the number of sites in each category.

Overall Age of Units and Relationship of Age to Use

The age of imaging equipment was assessed, with the average age of units presented in Table 8 and the summary of age categories presented in Table 9. The age of each unit was estimated by calculating the number of years since the first year of operation (i.e., 2020 minus the first year of operation). Information on a total of 1,522 units at 455 sites across Canada had data on the first years of operation. The majority of imaging equipment has 10 or fewer years of operation: 65.9% of CT units, 60.9% of MRI units, 59.2% of PET-CT units, 28.0% of SPECT units, and 73.6% SPECT-CT units. The age of previously used imaging equipment (according to the survey) could not be estimated.

Table 8: Average Age of Imaging Units by Modality

| Modalities | Number of sites | Number of units | Average age (years) | Minimal age (years) | Maximal age (years) |

|---|---|---|---|---|---|

| CT | 357 | 530 | 8.1 | 0 | 23 |

| MRI | 263 | 374 | 8.6 | 0 | 20 |

| PET-CT | 41 | 49 | 8.2 | 0 | 17 |

| PET-MRI | 5 | 5 | 4.8 | 2 | 8 |

| SPECT | 172 | 300 | 13.2 | 1 | 33 |

| SPECT-CT | 154 | 269 | 6.6 | 0 | 17 |

CT = computed tomography; MRI = magnetic resonance imaging; PET = positron emission tomography; PET-CT = positron emission tomography–computed tomography; PET-MRI = positron emission tomography–magnetic resonance imaging; SPECT = single-photon emission computed tomography; SPECT-CT = single-photon emission computed tomography–computed tomography.

Note: Data derived from the survey question: “What year did (or will) the [modality] unit become operational?” subtracted from 2020. Those to be installed were not included in this table.

Table 9: Age of the Imaging Units in Years

| Modality | Yearsa | |||||

|---|---|---|---|---|---|---|

| 5 or less | 6 to 10 | 11 to 15 | 16 to 20 | 21 to 25 | More than 25 | |

| Number of units (%) | ||||||

| CT | 189 (35.7) | 160 (30.2) | 152 (28.7) | 27 (5.1) | 2 (0.4) | 0 (0) |

| MRI | 122 (32.6) | 106 (28.3) | 106 (28.3) | 40 (10.7) | 0 (0) | 0 (0) |

| PET-CT | 13 (26.5) | 16 (32.7) | 19 (38.8) | 1 (2.0) | 0 (0) | 0 (0) |

| PET-MRI | 4 (75) | 1 (25) | 0 (0) | 0 (0) | 0 (0) | 0 (0) |

| SPECT | 31 (10.3) | 53 (17.7) | 106 (35.3) | 87 (29.0) | 20 (6.7) | 3 (1) |

| SPECT-CT | 126 (46.8) | 72 (26.8) | 68 (25.3) | 3 (1.1) | 0 (0) | 0 (0) |

CT = computed tomography; MRI = magnetic resonance imaging; PET = positron emission tomography; PET-CT = positron emission tomography–computed tomography; PET-MRI = positron emission tomography–magnetic resonance imaging; SPECT = single-photon emission computed tomography; SPECT-CT = single-photon emission computed tomography–computed tomography.

a Age for each unit calculated from the survey question: “What year did (or will) the [modality] unit become operational?” subtracted from 2020.

New or Used Units

Of 1,205 imaging units with information, 1,160 were newly purchased and 45 were previously used units. PET-CT is the most commonly reused imaging modality, with 7.3% of all units fitting into this category, and PET-MRI is the imaging modality least likely to be reused, with none of the units reused.

Computed Tomography

Number and Location of CT Units

Three hundred and sixty-nine sites in all provinces or territories have one or more CT units (mean 1.5 per site). There were up to nine units per site, for a total of 549 units (22 at free-standing sites). Ontario, Quebec, and British Columbia had the most CT units. The number of units in all provinces or territories ranged from 11.5 to 28.7 per million population, but this did not reflect accessibility, particularly in provinces and territories with large remote areas.

One hundred and eighty-nine CT units were installed between 2015 and 2019–2020. Among the units with information, 50 were replacements for decommissioned units, 13 were new units, and 54 were not specified as new or replacement. Forty-six sites had decommissioned one or more CT units (most decommissioned one unit) since the last survey in 2017, and 57 sites reported planned installations of one or more CT units in the next two years (Table 10).

Table 10: Summary of Availability and Status of CT Units by Province and Territory in 2019–2020

| Province or territory | Sites with availabilitya | Total unitsb (free-standing facilities) | Sites planning to install new or replacement units c | Sites decommissioning since 2017d | Units per million populatione |

|---|---|---|---|---|---|

| Alberta

|

43

|

55 (3)

|

4

|

6

|

12.5

|

| British Columbia

|

46

|

69 (2)

|

9

|

7 | 13.5 |

|

Manitoba |

16 | 22 (0) | 4 | 3 | 16.0 |

|

New Brunswick |

11 | 17 (0) | 4 | 2 | 21.8 |

|

Newfoundland and Labrador |

14 | 15 (0) | 1 | 3 | 28.7 |

|

Northwest Territories |

1 | 1 (0) | 0 | 1 | 22.3 |

|

Nova Scotia |

14 | 17 (0) | 5 | 1 | 17.4 |

|

Nunavut |

1 | 1 (0) | 0 | 0 | 25.7 |

|

Ontario |

107 | 169 (4) | 25 | 17 | 11.5 |

|

Prince Edward Island |

2 | 2 (0) | 0 | 1 | 12.7 |

|

Quebec |

100 | 164 (12) | 2 | 4 | 19.2 |

|

Saskatchewan |

13 | 16 (1) | 3 | 1 | 13.6 |

|

Yukon |

1 | 1 (0) | 0 | 0 | 24.4 |

|

Canada |

369 | 549 (22) | 57 | 46 | 14.5

|

CT = computed tomography.

a Data derived from number of units with technical details (make, model, first year of operation, and status as decommissioned/non-decommissioned), as provided by survey respondents to CMII and CIHI and industry sources.

b Data obtained from provincial validators.

c Data derived from the survey question: “Do you have plans to install the following in the next two years?”

d Data derived from the survey question: “Have you decommissioned a [modality] unit since January 2, 2017?”

e The population (estimated) as of fourth quarter, 2019.23

Free-Standing Institutes

Overall, there are 22 CT units at 22 free-standing institutes across Canada. Free-standing institutes were mainly identified as privately funded and are located in five provinces: Alberta, British Columbia, Ontario, Quebec, and Saskatchewan. Most sites did not provide information on examinations per year, with only three free-standing sites reporting these data.

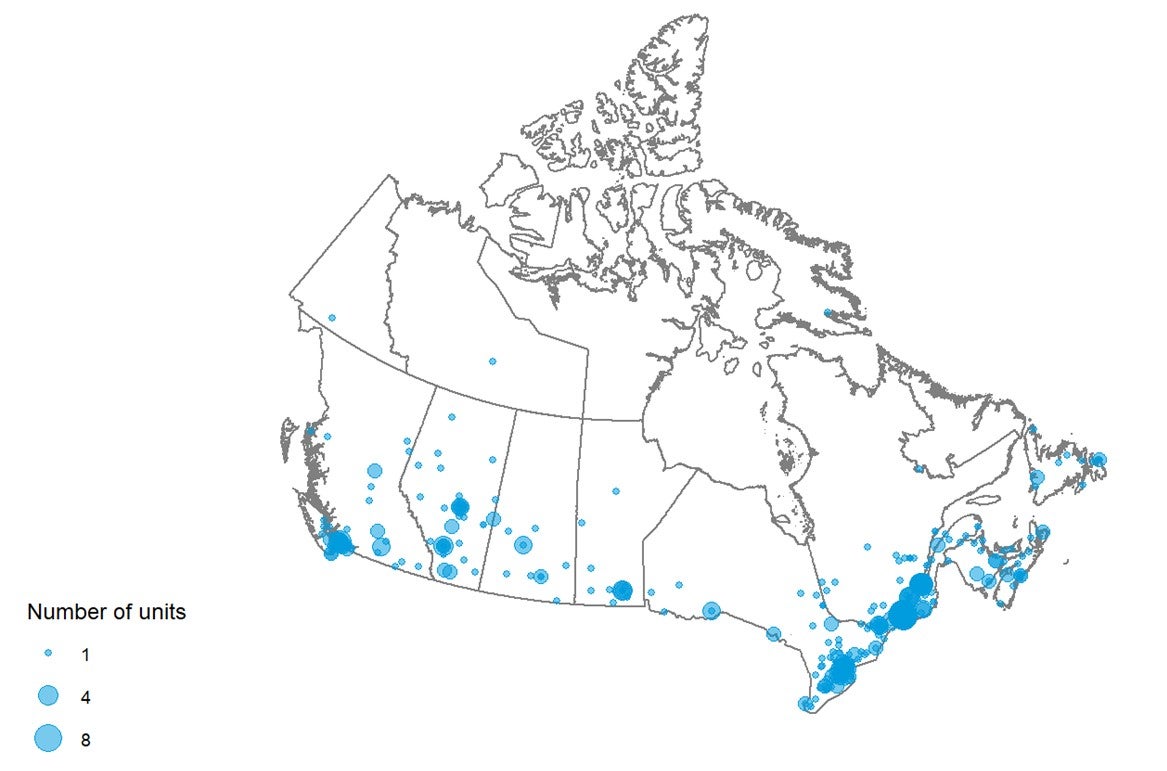

Geographical Distribution of CT Units in 2019–2020

Figure 4 shows the geographical distribution of CT units across Canada mapped to the level of settlement (city or town), with circle diameter proportional to the number of units. Counts for all sites within a city/town were aggregated.

Figure 4: Geographic Distribution of CT Units in Canadian Cities or Towns

CT = computed tomography.

Note: Availability and unit counts by site were derived from validator data; where these were unavailable, the data were from the survey. Mobile units appear as one unit at each of the sites served.

Mobile CT

Two sites indicated that they were served by two mobile units in Quebec. As well, there is a mobile stroke unit in Alberta that includes a portable CT unit.

Number of Examinations in a Fiscal Year

Across Canada, a total of 5,419,821 examinations per year were reported for 549 units. Data quoted were primarily supplied by provincial and territorial validators for either the latest fiscal year or calendar year and were supplemented with data from free-standing sites. The average number of exams per unit was 9,872.2. Table 11 shows the total number of exams by provinces and territories and the number of exams per thousand people.

Table 11: Total Examinations per Fiscal Year Using CT Units in 2019–2020

| Province or territory | Units with dataa (free-standing sites) | All unitsb | Total examsb | Exams per unit | Populationc | Exams per thousand population |

|---|---|---|---|---|---|---|

| Albertad | 55 (3) | 55 | 449,433e | 8,171.5 | 4,395,586 | 102.2 |

| British Columbia | 69 (2) | 69 | 805,584 | 11,675.1 | 5,105,576 | 157.8 |

| Manitoba | 22 (0) | 22 | 240,269 | 10,921.3 | 1,373,859 | 174.9 |

| New Brunswick | 17 (0) | 17 | 162,322d | 9,548.4 | 780,021 | 208.1 |

| Newfoundland and Labrador | 15 (0) | 15 | 98,967d | 6,597.8 | 521,922 | 189.6 |

| Northwest Territories | 1 (0) | 1 | 5,789 | 5,789.0 | 44,895 | 128.9 |

| Nova Scotia | 17 (0) | 17 | 170,603 | 10,035.5 | 976,768 | 174.7 |

| Nunavut | 1 (0) | 1 | 3,081 | 3,081.0 | 38,873 | 79.3 |

| Ontario | 169 (4) | 169 | 1,842,982 | 10,905.2 | 14,659,616 | 125.7 |

| Prince Edward Island | 2 (0) | 2 | 19,349d | 9,674.5 | 157,901 | 122.5 |

| Quebec | 164 (12) | 164 | 1,491,087d | 9,092.0 | 8,522,800 | 175.0 |

| Saskatchewan | 16 (1) | 16 | 124,918d | 7,807.4 | 1,178,657 | 106.0 |

| Yukon | 1 (0) | 1 | 5,437 | 5,437.0 | 41,022 | 132.5 |

| Canada | 549 (22) | 549 | 5,419,821 | 9,872.2 | 37,797,496 | 143.4 |

CT = computed tomography.

a Data derived from number of units with technical details (make, model, first year of operation, and status as decommissioned/non-decommissioned).

b Data derived from the question: “For all [modality] units, how many examinations on average were conducted in the last fiscal year?”

c The population (estimated) as of fourth quarter, 2019.23

d For Alberta, data from free-standing sites were excluded from the Alberta contribution, but are as follows: total exams: 2,364; total exams per unit: 788; exams per thousand population: 0.54. For the purposes of overall Canadian analysis and future projections, data from public and free-standing sites in Alberta have been combined and have been included in the Canadian total.

e Fiscal year 2018–2019.

Age of CT Units by CMII Survey Years

There are 317 out of 549 (57.7%) imaging units with information on the first years of operation. Table 12 shows the first years of operation by the CMII survey year (2015, 2017, and 2020) and jurisdiction. There were 60 CT units installed after the last CMII survey in 2017.

Table 12: First Years of Operation of the CT Units by Province and Territory

| Province or territory | 2015 years and earlier | 2016 to 2017 years | 2018 to 2020 years | 2021 years and later | Total |

|---|---|---|---|---|---|

| n (%) of currently operating units by first year of operation | |||||

| Alberta | 35 (79.5) | 6 (13.6) | 3 (6.8) | 0 (0) | 44 (100) |

| British Columbia | 25 (51) | 11 (22.4) | 13 (26.5) | 0 (0) | 49 (100) |

| Manitoba | 12 (60) | 7 (35) | 1 (5) | 0 (0) | 20 (100) |

| New Brunswick | 4 (66.7) | 2 (33.3) | 0 (0) | 0 (0) | 6 (100) |

| Newfoundland and Labrador | 6 (85.7) | 0 (0) | 1 (14.3) | 0 (0) | 7 (100) |

| Northwest Territories | 0 (0) | 1 (100) | 0 (0) | 0 (0) | 1 (100) |

| Nova Scotia | 15 (93.8) | 0 (0) | 1 (6.2) | 0 (0) | 16 (100) |

| Nunavut | NR | NR | NR | NR | NR |

| Ontario | 40 (74.1) | 13 (24.1) | 1 (1.9) | 0 (0) | 54 (100) |

| Prince Edward Island | 0 (0) | 1 (100) | 0 (0) | 0 (0) | 1 (100)

|

| Quebec | 65 (58.6) | 6 (5.4) | 40 (36) | 0 (0) | 111 (100) |

| Saskatchewan | 8 (100) | 0 (0) | 0 (0) | 0 (0) | 8 (100) |

| Yukon | NR | NR | NR | NR | NR |

| Canada | 210 (66.2) | 47 (14.8) | 60 (18.9) | 0 (0) | 317 (100) |

CT = computed tomography; NR = not reported.

Note: Data derived from the survey question: “What year did (or will) the [modality] unit become operational?”

Full-Time Equivalent Medical Radiation Technologists

Survey participants were asked to provide information on the number of full-time equivalent (FTE) MRTs assigned to all CT units at the site level. An FTE position for an MRT is considered to amount to an eight-hour day, five days per week.

One hundred and ninety-one sites (56.5% of 338 sites with CT units) reported information. There were one to 25 FTE MRTs assigned per site. For sites that have a single CT unit and a large number of MRTs assigned to that unit, survey respondents may have reported a total count at the facility level rather than the site level, the site may be located in densely populated area, and/or the CT unit may be in operation 24 hours a day. The numbers of FTE MRTs per site by provinces and territories are shown in Table 13.

Table 13: Numbers of Full-time Equivalent Medical Radiation Technologists per Site for CT Units by Province and Territory

| Province or territory | All sites with information | Total FTE MRTs | FTE MRTs per million population | Average per site | Minimal number per site | Maximal number per site |

|---|---|---|---|---|---|---|

| Alberta | 36 | 165 | 37.5 | 4.6 | 1 | 18 |

| British Columbia | 37 | 194 | 38 | 5.2 | 1 | 23 |

| Manitoba | 15 | 91 | 66.2 | 6.1 | 1 | 19 |

| New Brunswick | 7 | 31 | 39.7 | 4.4 | 2 | 7 |

| Newfoundland and Labrador | 13 | 37 | 70.9 | 2.9 | 1 | 6 |

| Northwest Territories | 1 | 2 | 44.5 | 2 | 2 | 2 |

| Nova Scotia | 10 | 50 | 51.2 | 5 | 2 | 15 |

| Nunavut | NR | NR | NR | NR | NR | NR |

| Ontario | 32 | 217 | 14.8 | 6.8 | 1 | 21 |

| Prince Edward Island | 1 | 3 | 19 | 3 | 3 | 3 |

| Quebec | 27 | 166 | 19.5 | 6.2 | 1 | 25 |

| Saskatchewan | 11 | 50 | 42.4 | 4.6 | 1 | 11 |

| Yukon | 1 | 3 | 73.1 | 3 | 3 | 3 |

| Canada | 191 | 1,009 | 26.7 | 5.3 | 1 | 25 |

CT = computed tomography; FTE = full-time equivalent; MRT = medical radiation technologist; NR = not reported.

Note: Data derived from the survey question: “How many FTE technologists are assigned to all [modality] units (collective number of FTEs for all units)?”

Typical Hours of Operation in a Week, and All-Day and Weekend Use

Hours Per Day and 24-Hour Use for CT Units

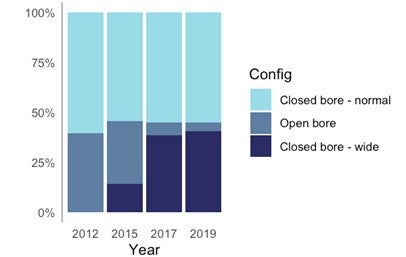

Two hundred and sixty out of 455 publicly funded sites provided data for the average number of hours per day that CT units were in use. Across all provinces or territories, CT units were used for an average of 8.5 hours to 14.1 hours per day (Table 87). Seventy-four (28.5%) units were used for less than eight hours per day, 80 (30.8%) units were used for eight to less than 12 hours per day, 69 (26.5%) units were used for 12 to less than 18 hours a day, and 37 (14.2%) units were used for more than 18 hours per day. Eighty-nine (34.2%) sites reported that at least one unit at their site was used for 24 hours a day (Table 88).

Hours Per Week and Weekend Use for CT Units

Two hundred and sixty-one out of 455 publicly funded sites provided data for the average number of hours per week that CT units were in use. Across all provinces or territories, CT units were used for an average of 45 hours to 93.5 hours per week. Sixty-three (24.1%) units were used for less than 20 hours per week, 57 (21.8%) units were used for 40 to less than 60 hours per week, 37 (14.2%) units were used for 60 to less than 80 hours per week, 55 (21.1%) units were used for 80 to less than 120 hours a week, and 49 (18.8%) units were used for more than 120 hours per week (Table 89). One hundred and ninety-nine (76.2%) sites reported that at least one unit at their site was used at weekends (Table 90).

Planned and Unplanned Downtime for CT Units

Among the 317 sites with CT units, 184 sites reported the planned and unplanned downtime in a year. The mean planned downtime was 35.4 hours, ranging from three to 288 hours per year. The mean unplanned downtime was 50.1 hours, ranging from 0 to 359 hours per year. At 82 sites, the planned downtime was less than unplanned downtime for 82 imaging units. Some common reasons for discrepancies between planned and unplanned downtime include catastrophic failure, equipment breakdown (especially older equipment, which may break down more frequently), difficulty sourcing parts, waiting for parts, tube replacement, software upgrades, and power outages. The distributions of planned and unplanned downtime for CT units by jurisdiction are shown in Table 14 (Table 91 and Table 92).

Table 14: Annual Planned and Unplanned Downtime at Sites with CT Units by Province and Territory

| Province or territory | Annual downtime – planned (hours) | Annual downtime – unplanned (hours) |

|---|---|---|

| Mean downtime, hours per year (n, range) | ||

| Alberta | 28.1 (39, 12 to 108) |

45.9 (39, 5 to 359) |

| British Columbia | 45.5 (31, 9 to 288) |

57.3 (18, 10 to 240) |

| Manitoba | 33.7 (15, 12 to 96) |

82.7 (13, 16.5 to 300) |

| New Brunswick | 34.3 (7, 16 to 72) |

53.4 (7, 24 to 120) |

| Newfoundland and Labrador | 29.6 (13, 12 to 84) |

21.8 (11, 10 to 48) |

| Northwest Territories | 35 (1, 35 to 35) |

15 (1, 15 to 15) |

| Nova Scotia | 27 (9, 15 to 48) |

54.1 (8, 20 to 144) |

| Nunavut | NR | NR |

| Ontario | 38.8 (30, 8 to 220) |

50.3 (23, 0 to 300) |

| Prince Edward Island | 48 (1, 48 to 48) |

12 (1, 12 to 12) |

| Quebec | 40 (25, 3 to 168) |

41.4 (21, 0 to 168) |

| Saskatchewan | 30.9 (11, 16 to 96) |

71 (7, 8 to 200) |

| Yukon | 10 (1, 10 to 10) |

20 (1, 20 to 20) |

| Canada | 35.4 (183, 3 to 288) |

50.1 (150, 0 to 359) |

NR = not reported.

Note: Data derived from the survey question: “How much planned downtime is anticipated for scheduled maintenance for all units in a given year? (expressed in hours)” and “How much unplanned downtime is experienced for all units in a given year? (expressed in hours).”

Types of CT Use

Survey participants were asked to provide the overall percentage of use for cardiac exams, noncardiac exams, research, and any other type of use. Usage breakdown was available for 178 sites. On average, the highest mean percentage of use for CT was noncardiac, at 95.5% (range 0% to 100%), followed by cardiac use, at 1.4% (range 0% to 15%), and research use, at 0.6% (range 0% to 30%). The percentages of cardiac, noncardiac, and research use are available in Table 93.

Survey participants reported the overall percentage of use for CT for diagnostic, interventional, and research purposes, as well as other type of use. Usage breakdown was available for 188 sites with CT units. On average, the highest mean percentage of use for CT was for diagnostic use, at 93.8% (range 0% to 100%), followed by interventional use, at 4% (range 0% to 60%), and research use, at 0.5% (range 0% to 21%).

Data on the overall percentage of use by discipline for all CT units were collected from survey participants. The categories included oncology, respiratory, hepatobiliary, musculoskeletal, inflammatory or infectious disease, neurological, cardiac, trauma, and other. Usage breakdown was available for 122 sites with CT units. On average, the highest mean percentage of use for CT was oncology exams, at 24.9% (use at individual sites ranged from 0% to 100%), followed by neurological exams, at 17.9% (range 0% to 55%), hepatobiliary exams, at 13.3% (range 0% to 40%), and respiratory exams, at 12.9% (range 0% to 40%). Details are available in Table 94. Due to the low response rate, data may not be representative of all sites.

Clinical Decision Support Tools for CT Units

Survey participants were asked to provide information on the adoption of CDSTs at the point of care by referring physicians ordering CT exams. A CDST was described as a tool that provides real-time guidance to physicians on the appropriateness of diagnostic imaging tests for a given patient during the ordering process. Among the 169 sites with information on the use of CDSTs, 103 (61.0%) reported that referring physicians used CDSTs for CT exams. The use of CDSTs by province or territory is summarized in Table 15.

Table 15: Use of Clinical Decision Support Tools at Sites with CT Units by Imaging Modality

| Province or territory | CDST used | CDST not used | Total |

|---|---|---|---|

| Number of sites (%) | |||

| Albertaa | 0 (0) | 39 (100) | 39 (100) |

| British Columbia | 25 (78.1) | 7 (21.9) | 32 (100) |

| Manitoba | 14 (93.3) | 1 (6.7) | 15 (100) |

| New Brunswick | 4 (80) | 1 (20) | 5 (100) |

| Newfoundland and Labrador | 8 (66.7) | 4 (33.3) | 12 (100) |

| Northwest Territories | 1 (100) | 0 (0) | 1 (100) |

| Nova Scotia | 8 (100) | 0 (0) | 8 (100) |

| Nunavut | NR | NR | NRtd |

| Ontario | 23 (82.1) | 5 (17.9) | 28 (100) |

| Prince Edward Island | NR | NR | No data |

| Quebec | 12 (66.7) | 6 (33.3) | 18 (100) |

| Saskatchewan | 7 (70) | 3 (30) | 10 (100) |

| Yukon | 1 (100) | 0 (0) | 1 (100) |

| Canada | 103 (61.0) | 66 (39.0) | 169 (100) |

CDST = clinical decision support tool; CT = computed tomography; NR= not reported.

a Data from 2018–2019.

Note: Data derived from the survey question: “Is a clinical decision support tool used at the point of care by medical professionals referring patients to medical imaging? A clinical decision support tool provides real-time guidance to physicians on the appropriateness of diagnostic imaging tests for a given patient during the ordering process.”

Use of Peer Review for CT Images

Survey participants were asked to provide information on the use of peer review as a quality assurance tool for reading and interpreting images. Of 176 sites that responded to the question as to whether CT images were peer-reviewed, 110 (62.5%) responded “yes.” Alberta had the highest use of peer review, with 100%, followed by Ontario and British Columbia. The use of peer review at site level is summarized by province or territory in Table 16.

Table 16: Use of Peer Review for CT Images, Summarized by Province/Territory

| Province or territory | Conduct peer review | Do not conduct peer review | Total |